Verifying a patient’s insurance coverage before their appointment is a key step in the medical billing process. Insurance eligibility verification helps healthcare providers determine what services are covered under a patient’s insurance plan and what costs the patient will pay out of pocket. Collecting out-of-pocket payments in real-time can provide several advantages for your practice and your patients.

“Patient receivables account for 30 percent of provider revenue, yet less than 60 percent is collected”, according to a 2022 Revenue Cycle Management article. The report noted that high costs have consumers skipping payments due to affordability or skipping treatment altogether, leading to increased bad debt, decreased patient volume, and overall losses in provider revenue.

In order to maintain a strong bottom line and optimize revenue cycle management (RCM), health systems must have proper systems to place to collect patient receivables.

Streamline your medical billing process, boost patient collections and optimize your revenue cycle!

Out-of-Pocket Costs – What Providers Should Know

Out-of-pocket costs are the expenses that patients pay for medical services that are not reimbursed by their health insurance plan. Listed in the insurance plan’s Summary of Benefits and Coverage (SBC) document, out-of-pocket costs include copayments, coinsurance, deductibles, and other medical expenses not paid by the plan.

Patient financial responsibility is rising. After the Affordable Care Act (ACA) came into effect in 2010, there was an increase in high-deductible plans in the U.S. healthcare market. This change resulted in the shifting of a larger portion of out-pocket payments such as deductibles and co-pays, onto patients. A 2015 report from the University of Delaware noted that research shows that costs are going up each year by about 5%. This implies that consumers can expect to pay 5% more each year.

Here is a breakdown of out-of-pocket costs:

- Copayments are predetermined, fixed amounts that patients are responsible for paying when receiving covered healthcare services. The specific amount of the copayment can vary depending on the type of service rendered.

- The deductible is the predetermined amount that patients are responsible for paying out of pocket for healthcare services before their insurance coverage comes into effect. While not all services may be subject to the deductible, if a patient’s plan has a $1000 deductible, their insurance will not pay towards the cost of covered services until they have personally paid the full $1000 deductible amount.

- Coinsurance represents the patient’s share of a covered health care service, calculated as a percentage of the allowed amount for the service. The health insurance plan will pay the rest of the allowed amount directly to the service provider.

Verifying patients’ coverage and benefits can ensure comprehensive information about a patient’s insurance plan. Leveraging professional insurance authorization and verification services is an ideal way to manage this step in the medical billing process. Before the patient encounter, insurance verification specialists will review the patient’s insurance plan to determine the active status of the policy and coverage details, including co-pays, deductibles, and out-of-pocket maximums.

It’s important that you estimate out-of-pocket costs accurately and collect them in real-time. Your RCM processes need to adapt to effectively manage patient payment collection, which includes implementing clear and proactive communication about costs, offering flexible payment options, and optimizing patient financial counselling.

The Importance of Real-time Collection of Out-of-Pocket Costs

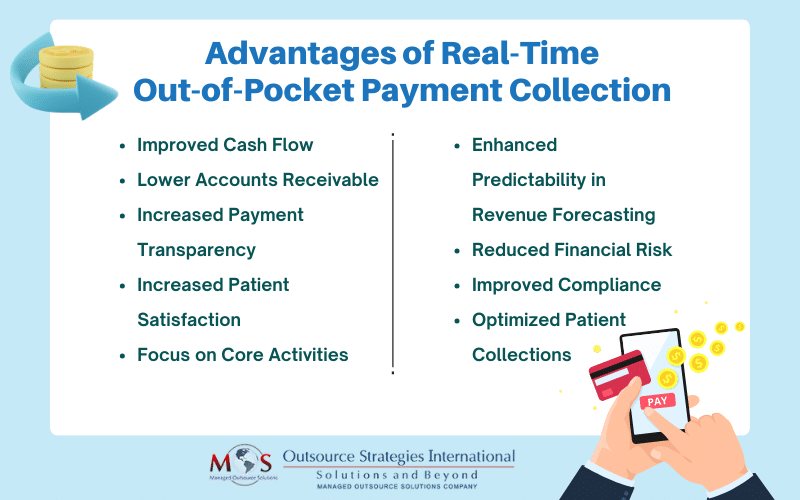

Collecting out-of-pocket payments in real time offers several advantages for your practice.

Here are some potential benefits:

Improved Cash Flow

By collecting payments at the time of service, you can reduce the risk of delayed or missed payments and ensure a steady and timely influx of revenue. A healthier cash flow will contribute to better financial stability, helping you meet operational expenses, increase investments in technology, and enhance patient care.

Lower Accounts Receivable

Timely collection of out-of-pocket payments will reduce the amount of outstanding accounts receivable. You can minimize the risk of unpaid bills and bad debt by collecting payment at the time of service. This will help you avoid the challenges of managing unpaid balances and chasing after overdue payments.

Increased Payment Transparency and Patient Satisfaction

Collecting payments in real-time will allow your patients to understand their financial obligations upfront. This will help them make informed decisions about their healthcare expenses and encourage them to take responsibility for their out-of-pocket costs. When patients are actively involved in managing their healthcare costs, it can lead to better communication and increased trust, enhancing the overall patient experience. Your patients will also appreciate the transparency in healthcare costs and the convenience of settling their financial obligations promptly, improving their satisfaction and loyalty.

Focus on Core Activities

When you collect payments in real-time, there will be less need for follow-up collection efforts. This means that you and your staff can dedicate more time and effort to valuable tasks, such as patient care, as well as administrative responsibilities that directly contribute to your practice’s success.

Enhanced Predictability in Revenue Forecasting

Real-time payment collection will provide you with a clearer understanding of your cash inflow. It will enable greater predictability in revenue forecasting and allow you to plan and allocate resources effectively.

Reduced Financial Risk

By collecting payments at the time of service, you mitigate the financial risk associated with unpaid or delayed payments. This is particularly important for smaller practices that may have limited resources to absorb losses. Real-time payment collection will help you minimize the impact of financial uncertainties, allowing you to maintain stability and profitability.

Improved Compliance

Adhering to real-time payment practices will help your practice stay compliant with evolving healthcare regulations. It ensures that your financial transactions align with regulatory requirements, minimizing the risk of legal issues and penalties.

Leverage Expertise, Optimize Patient Collections

Implementing real-time payment collection systems requires appropriate technology infrastructure and processes. Partnering with an experienced medical billing company is a practical solution to ensure this. These companies provide real-time eligibility verification to determine the patient’s financial responsibility, including copayments, deductibles, and coinsurance. By obtaining this information before services are provided, you can inform patients upfront about their out-of-pocket costs. This can ensure a seamless patient collection process at the point of service, optimize your revenue cycle, and enhance the patient experience.

Ensure timely patient insurance eligibility verification and enhance practice workflow and efficiency!