According to a report from the American Health Information Management Association (AHIMA), nearly 20 percent of all claims are denied, with average claims denial rates reaching 10 percent or more. Health insurance companies deny claims for various reasons such as incomplete or missing billing information, coding errors, late filing, duplicate claims, service not covered, and lack of preauthorization.

When claims are denied, your patients may be responsible for paying the cost of the denied services out-of-pocket. Appealing and resubmitting denied claims require significant time and resources. The best defense is to prevent denials from happening in the first place. As a medical billing company with years of experience in the field, we have put together some proven strategies that can help your practice prevent claim denials.

Say goodbye to billing headaches and optimize revenue with our medical coding and billing services!

To implement preventive strategies, it’s important to first understand why payers deny claims.

Common Reasons why Health Plans deny Claims

- Not obtaining prior authorization

Some services require preauthorization from the payer - Errors in the claim

Missing or erroneous information, for e.g., missing social security number, wrong demographic information, and incorrect or missing medical codes - Payer does not cover the service/procedure

Happens if your practice didn’t verify the patient’s insurance before the office visit - Not medical necessary

The payer does not recognize the service as medically necessary - Benefit has been exceeded

The billed service exceeded the plan’s allowable limit - Not in the insurance company’s network

The provider is not in the payer’s network - Duplicate claims

More than one claim was submitted for the same patient for the same service on the same day by the same provider - Poor documentation

Submitting documentation that incorrect, illegible, or incomplete - Coordination of benefits not updated

Failing to update coordination of benefits for patients with multiple health plans can lead to delays or denials. - Late filing

Happens when you don’t meet the payer’s time limit for claims submission

When payers deny a claim, they will provide detailed explanations for the denial. You can always appeal a denied claim. When appealing it, ensure that the denial isn’t part of any contractual adjustment to avoid it becoming a write-off. The claim must be resubmitted for reconsideration within the time frame allowed, ensuring that all the missing details are filled in. The appeal process must be in keeping with the insurer’s protocols.

Your office can appeal the claim, but this is a costly and time-consuming process. The AHIMA report notes that the average cost to rework or appeal denials is $25 per claim for practices and a whopping $181 per claim for hospitals. That’s why it’s important to get as many claims approved on the first attempt.

Strategies to Avoid Claim Denials and Resubmissions

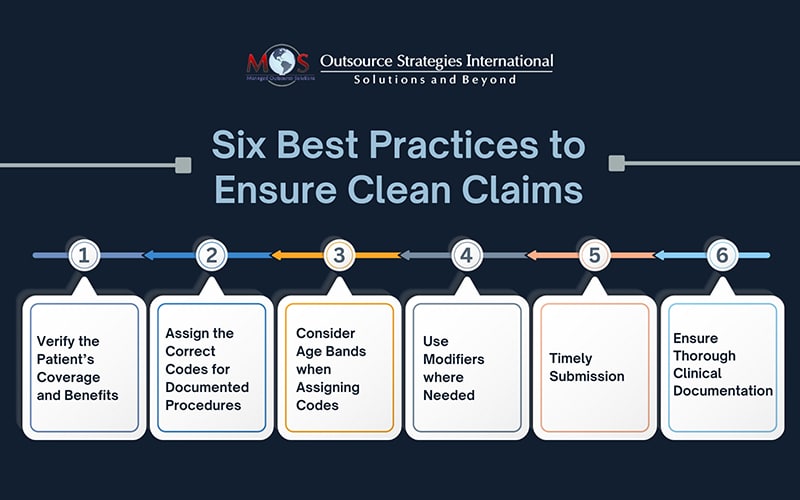

Here are six best practices to ensure clean claims on the first go.

- Verify the Patient’s Coverage and Benefits

Insurance eligibility verification is necessary to understand what services the patient’s plan covers, policy status, effective dates, co-payments, deductibles, and prior authorizations. Understand the preauthorization and prior approval requirements of insurance companies and obtain necessary approvals for procedures, tests, or medications to ensure compliance and prevent claim denials. Checking patient insurance eligibility prior to providing services will allow you to identify any potential coverage issues or limitations that may lead to claim denials.

- Assign the Correct Codes for Documented Procedures

Assign the appropriate CPT, ICD-10, and HCPCS codes for the documented diagnoses, procedures, and services. Review complete medical documentation, identify the procedures performed, and assign the correct CPT codes that describe each procedure. Regularly educate and train coding staff to ensure they stay updated with the latest coding guidelines and regulations.

- Consider Age Bands when Assigning Codes

Both ICD-10 codes and CPT codes can be age-banded. Choosing the accurate age-banded procedure codes is necessary to avoid claims denial and resubmission. For example, the CPT codes for vaccine administration codes are differentiated based on the age of the patient at the time of exam, codes for patients through age 18 years, and a different set of administration codes for patients over 18 years of age.

- Use Modifiers where Needed

Modifiers tell the story of a particular encounter. Inconsistent or missing modifiers can not only lead to denials but also compliance issues and audits. Determine if the circumstances involved with the procedure or service requires the use of modifiers. Check the National Correct Coding Initiative (NCCI) table and the procedure-to-procedure (PTP) edits to select the right modifier and to avoid bundling issues.Here’s an example from the AMA: if a lesion excision and skin repair were performed on a single service date, you cannot code the repair separately as simple repairs are included in the excision codes. If the sites of the skin repair and lesion removal are different, it is appropriate to bill for both and append a modifier to let the payer know the procedure was indeed separate from the excision.

- Timely Submission

Make sure that claims are submitted within the specified timeframes required by insurance companies. This depends on having efficient billing processes and systems in place.

- Ensure Thorough Clinical Documentation

Maintain clear and accurate medical records, including meticulous documentation of all patient information, medical history, diagnoses, and procedures. Submit claims with all the necessary information and supporting documentation to help payers understand the medical necessity of the services rendered and validates the claims made by your practice. Ensure that the patient’s condition and the medical services rendered are accurately reported using the correct ICD-10 and CPT codes. Proper training for healthcare providers and staff is an essential aspect of ensuring accurate and thorough documentation.

Reach out to an Expert

With all these rules and guidelines, ensuring accurate claim submission and preventing denials can be challenging for any medical practices. Fortunately, expert support is available in the form of outsourced medical billing services. Skilled billing professionals and coders are well-versed in all aspects of submitting claims for medical services and stay updated on changing regulations. They will also maintain open lines of communication with insurance companies on claim denials to address any requirements and prevent future denials.