Healthcare providers need to commit to medical coding best practices to minimize coding errors and ensure compliance with coding guidelines. Failure to meet the medical coding legal and regulatory standards can lead to costly audits for practices. With the rising incidence of healthcare fraud, Medicare and private payers are scrutinizing coding errors more closely. To mitigate the likelihood of facing a medical audit, practices need to adhere to the best practices and ensure regulatory compliance. Partnering with a medical coding company is an ideal way for healthcare providers to optimize the coding process.

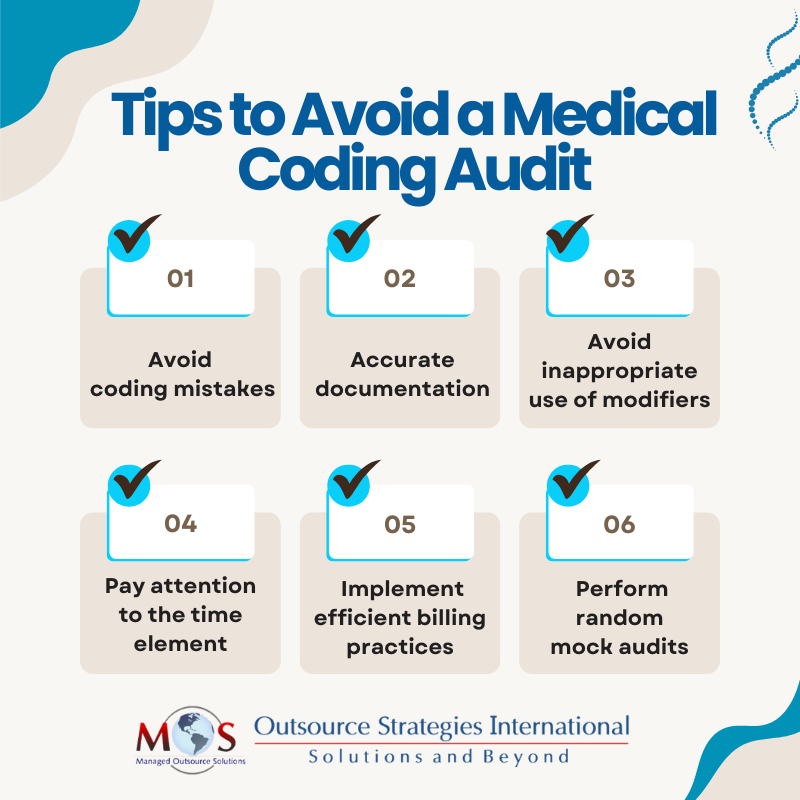

Let’s explore a few strategic approaches to avoid medical coding audits.

Strategies to Prevent a Medical Coding Audit

Avoid Coding Mistakes

Accurate and complete coding is essential to avoid errors like upcoding, downcoding, and obsolete codes. Coding errors can happen either inadvertently or intentionally, but come with heavy consequences such as compliance issues, financial loss, and penalties. Experts recommend that physicians follow the “SOAP” (subjective, objective, assessment and plan) note approach, which offers guidelines to effectively document a case for accurate coding.

Medical facilities can streamline the coding process with the integration of automated coding tools. An automated clinical coding process can detect coding errors and discrepancies in real time with high speed and accuracy. As the CPT, ICD-10-CM, and other medical codes are updated every year, it is important to integrate the latest coding information in the automated codebase. Importantly, before finalizing them, coders should reassess the clinical record to ensure the assigned codes are appropriate and consistent for the visit.

Accurate Documentation

The foundation of the medical coding process is precise and comprehensive documentation of the patient encounter, which enables proper reimbursement for the services rendered. Practices cannot afford to make mistakes in documentation.

The documentation of the present illness must be based on the patient’s narrative on that day, and should not be copied and pasted from the previous visit if it has no relevance to the problem. Only the relevant medical details should be recorded with respect to the specific clinical visit. Physicians should avoid the usage of “routine” for a main complaint, as this is a flag for auditors. So it is important to describe the purpose of the patient’s visit such as ‘here for an X-ray.’ Overcrowding the clinical documentation with unnecessary medical information may result in increased coding errors, delayed claims, and potential exposure to audits.

Avoid Inappropriate Use of Modifiers

Modifiers are used when medical coders want to convey further information about the procedure or the service to reflect any changes in the manner in which the physician performed it. Usage of the right modifiers clarifies the patient circumstances so the coding process can be done with a higher level of specificity. When submitting claims to the insurers, a high pattern of inaccurate modifiers may lead to practices getting flagged for scrutiny by payers.

Furthermore, improper modifiers in claim submission may cause a legitimate claim to be denied. Coders can enhance the accuracy of modifier usage by closely inspecting the clinical document to verify the necessary details regarding the procedure performed. As not all modifiers can be used with HCPCS or CPT codes, medical coders have to stay updated on the latest coding guidelines and payer-specific requirements.

Pay Attention to the Time Element

If the time spent with the patient is within the service range area of the patient’s chart, there is nothing to worry about. However, if extra time is spent with the patient, it is important to justify that. Physicians may spend extra time explaining treatment options, risks and benefits, patient education and counseling, and so on. Make sure this is specified in the documentation.

Compliance with Regulations

The medical industry is subject to constant regulatory and legal updates, and coders must navigate this evolving regulatory landscape judiciously. They must be aware of the latest guidelines in healthcare regulations such as the Health Insurance Portability and Accountability Act (HIPAA) and the False Claims Act. Proper compliance requires meticulous attention to detail and consistent efforts to enhance the integrity of the coding process. Reporting specific diagnosis codes to accurately communicate about the patient’s condition can also reduce the risk of audits.

Implement an Efficient Billing Process

Streamlining the medical billing process can significantly reduce errors that may trigger an audit. Double billing is a common error that can lead to serious consequences such as penalties, revenue loss, and scrutiny. An efficient billing process facilitates a collaborative work environment and transparent communication with the payers.

Integrate reliable medical billing software that works seamlessly with the existing electronic health record (EHR) to flag potential coding errors and correct them. Medical coding and billing go hand in hand, so accurate coding is essential for an optimized billing process. By enhancing the efficiency and accuracy of the billing process, practices can minimize the risk of audits.

Perform Random Mock Audits

Despite maintaining best efforts for coding practices, audits may still occur, so having a response plan in advance is critical to handle audits efficiently. Focus on conducting random mock audits as a strategic assessment to uncover any underlying issues and mitigate them effectively before they turn into severe problems. Although mock audits might be an additional expenditure, carrying out them out on a random basis can provide awareness about what can be expected from an external audit.

Mock audits are separate from internal audits, as the purpose of an internal audit is to assess the practice’s internal administrative and operational efficiency. A mock audit can identify problems like overcodes and undercodes and help in improving the documentation and coding, thus the potential for errors. When you perform a mock audit, look for billing or coding inaccuracies, lack of supporting documentation, and duplicate claims. Implementing a feedback system post mock audits is beneficial to identify areas for improvement and mitigate any compliance issues at the earliest.

The rise in patient volume and the need to focus on care is leading more and more practices to rely on professional medical coding services. Outsourcing companies offering these services employ certified coders well-versed in current coding guidelines and regulations. With expert support, physicians can ensure accurate coding and claim submission, foster regulatory compliance, and avoid auditor scrutiny.

Boost your practice’s coding accuracy, minimize audit risks, and maximize revenue!

To speak with an expert