Did you know that unresolved claims denials result in an average annual loss of $5 million for hospitals and represents up to 5 percent of net patient revenue?

While physicians concentrate on providing high-quality patient care, they need to establish effective medical billing procedures to avert denials and optimize reimbursement, including effective strategies for accurate insurance verification. Verification of patient benefits is an essential aspect of the billing process and managing it efficiently is crucial for appropriate and prompt reimbursement. It involves checking insurance details such as coverage limits, copayments, deductibles, and more. Confirming this information prior to providing services plays a crucial role in averting claim rejections linked to eligibility concerns, promoting optimal cash flow and enhancing the overall patient experience.

Accurate insurance verification helps streamlines the billing process, prevents claim denials, and optimizes reimbursement

The complexity involved in the process has made outsourcing insurance verification and authorization to experts a sound strategy. It ensures precision in the verification process, which is crucial for financial success.

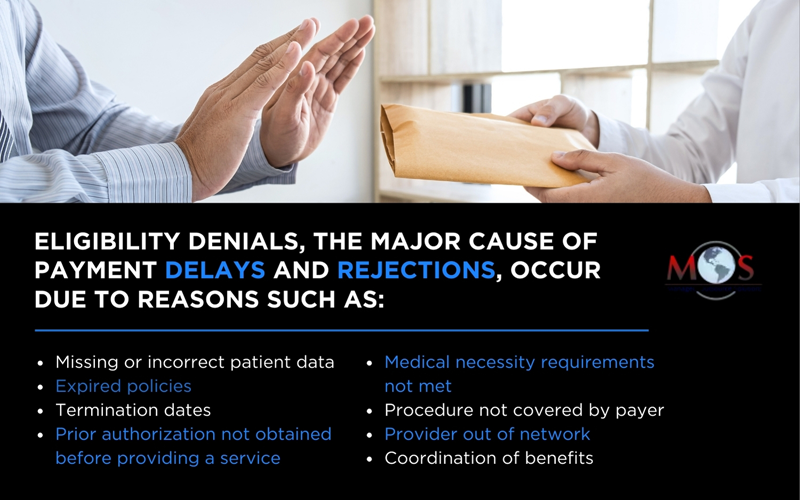

Understanding Eligibility Denials in Medical Billing

Incomplete or inaccurate details range from empty fields to errors like an incorrect plan code or a missing modifier. These issues prompt 61% of initial medical billing denials and account for 42% of denial write-offs (Change Healthcare). When services are provided by an out-of-network provider, a payer may deny all or part of the claim. Additionally, claims for patients with coverage under multiple health plans can lead to delays or denials until the patient’s coordination of benefits is updated.

Say goodbye to delayed payments and claim denials with expert insurance verification services

Prioritizing insurance eligibility verification can prevent denials due to these reasons. By verifying a patient’s insurance coverage and eligibility for treatment, healthcare organizations can identify the relevant payer(s) for claim submission, estimate patient responsibility, and secure timely payment at the point of service.

Guidelines for Maintaining Accuracy in Healthcare Insurance Verification

Here are some best practices for accurate patient eligibility verification:

Verify patient eligibility when scheduling the appointment

Collect all demographic and insurance details during patient scheduling and enrollment. Check the patient’s insurance coverage when scheduling the office visit. Verifying the patient’s eligibility at this point ensures that they are qualified for the specific treatment or appointment requested.

Double check the information collected during pre-registration

Review and validate the data gathered during pre-registration to ensure accuracy and completeness. Double-checking greatly helps to prevent errors.

OSI’s experienced teams specialize in verifying insurance coverages for multispecialty practices with multiple providers on site. We ensure that services are accurately categorized according to the appropriate provider/NPI, guaranteeing proper payment for those services. Our teams audit on the back end to ensure the benefits we provide are accurate.

Check eligibility at registration: Verify the patient’s eligibility for medical services during the registration process to ensure accurate and up-to-date information. This involves checking the patient’s active coverage with the insurer, including:

- Confirming the specific benefits available to the patient under their insurance plan, including coverage for the intended medical services.

- Reviewing the insurance policy to ensure it is active and has not expired.

- Checking for any exclusions or limitations that may affect the verification process.

Explore a detailed explanation of compliance and quality assurance

Determine prior authorization requirements: Identify and assess the prerequisites for obtaining prior authorization. Obtaining approval from the insurance company for a specific medical procedure or service is essential for ensuring that necessary approvals are obtained before proceeding with specific medical services, preventing potential delays or denials in the healthcare process.

Document the verified information: Maintain thorough documentation of the verification process, including communication with insurance providers and any obtained authorizations.

Inform the patient about coverage: Communicate with the patient to provide information about their insurance coverage. This involves sharing details regarding the extent of their insurance benefits, coverage limitations, potential out-of-pocket costs, and any relevant policy information. Keeping patients informed contributes to transparency and helps them understand their financial responsibilities.

Generate the price estimate for the patient: This involves calculating and presenting an approximation of the expected expenses associated with the proposed medical services, allowing the patient to anticipate and plan for potential costs. Providing a price estimate enhances transparency and empowers patients to make informed decisions about their medical care.

Address discrepancies: Resolve any discrepancies or issues identified during the verification process, collaborating with both the patient and the insurance provider as needed.

Update the billing system: Enter all insurance verification and eligibility details in your practice’s billing system

Monitor reasons for eligibility related denials: Track and document the causes of eligibility-related claim denials. By systematically tracking the reasons for these denials, healthcare providers can identify patterns, address recurring issues, and implement targeted improvements in the eligibility verification process. This proactive approach helps reduce denial rates and enhances the overall efficiency of the billing system.

Ensure HIPAA compliance in insurance eligibility checks: This requires ensuring that protected health information (PHI) is handled with the highest standards of security. Ensuring the confidentiality of patient information requires adherence to the HIPAA Privacy Rule for both oral and written communications, along with compliance with the HIPAA Security Rule for electronic transactions.

Prioritizing accurate eligibility verification is a pivotal element in your revenue cycle management, enhancing overall financial stability. Inaccuracies or gaps in eligibility verification, especially at critical junctures in the cycle, can lead to delayed healthcare services, payment issues, and potential claim denials. Without a robust eligibility verification process, your practice may incur financial losses. Thorough network status verification also aids in compliance with No Surprises Act rules.

Furthermore, eligibility verification serves as a valuable tool for patients, enabling them to anticipate their financial responsibilities, reducing the likelihood of unexpected expenses, and alleviating unnecessary stress. This process empowers patients to plan effectively for their healthcare services and explore alternative providers if needed.

Eligibility-related claim denials are preventable with the right support

Outsourcing this task to experienced professionals can help adhere to these best practices. Established insurance verification companies have expert teams that are knowledgeable about the nuances of diverse insurance plans. Their expertise ensures the precise and timely completion of the verification process well before patient appointments and as needed thereafter. Utilizing these services can save your practice the time and resources required to internally manage the intricate process of health insurance eligibility verification.

Boost financial stability and streamline your healthcare processes with accurate patient eligibility verification!