In the healthcare sector, podiatry is a specialty with unique medical billing and coding challenges. Podiatrists have to deal with diverse foot conditions, and not all services are covered by insurers. Podiatry billing and coding is complex, as procedures and services related to the foot are very specific because of medical necessity requirements and restrictions on the conditions that can be treated. As a podiatrist, your practice concentrates on diagnosing, treating, and preventing foot, ankle, and lower extremity conditions. To ensure prompt payment for your podiatry services and optimize your revenue cycle, it is necessary to adopt effective podiatry billing practices. In addition, since this specialty primarily treats the elderly, accurate knowledge of relevant medical codes is also required, as they are covered by Medicare. As podiatry billing is complicated, relying on knowledgeable providers of medical billing services is a practical strategy to maximize revenue and minimize claim denials in podiatry practices.

Common Challenges in Podiatry Medical Billing and Coding

Specific coding requirement A primary challenge of podiatric billing is the specificity of the coding requirements. in the coding process. Podiatrists diagnose and treat a wide range of foot and ankle conditions, including fractures, sprains, infections, deformities, sports injuries, diabetic foot complications, and more. They perform procedures and treatments that are different from other medical specialties, such as:

- Bunionectomies, hammertoe corrections, Achilles tendon repairs, ankle arthroscopy, and joint fusions

- Non-surgical treatments like orthotics, physical therapy, wound care, and pain management

- Assessment of the biomechanics of the lower extremities to identify abnormalities in foot structure or function that can cause plantar fasciitis, flat feet, or gait abnormalities

- Management of foot complications related to diabetes

- Foot and ankle sports injuries and their treatment

- Coordinated care for foot and ankle conditions connected to systemic diseases, such as rheumatoid arthritis or vascular disorders

- Preventive care to minimize the occurrence of foot problems, especially in the elderly and individuals with chronic conditions

Accurate diagnosis, followed by proper documentation and coding is necessary to bill for the procedures rendered by podiatrists, ensuring compliance and timely reimbursement.

Streamline your podiatry practice’s billing process and maximize revenue by hiring our dedicated team of billing specialists!

Compliance with Coding Guidelines

The healthcare sector is a dynamic landscape, with the regulatory bodies governing podiatry billing bringing constant changes in coding requirements. One of the most significant challenges in podiatry is to stay abreast of the regulatory changes in coding standards. Podiatry coders must adhere to coding guidelines set by organizations such as the American Medical Association (AMA) and the Centers for Medicare and Medicaid Services (CMS). Adherence to the coding guidelines is mandatory to avoid denials, delays in payment, or potential audits. Coders need to be familiar with the podiatry-specific CPT and ICD-10 codes for these conditions as well as modifier use. It is possible to use multiple modifiers with a single procedure code if necessary, although not all modifiers are applicable to every category of CPT codes. Certain modifiers are exclusive to specific categories, while others are incompatible with certain modifiers. By hiring medical coding services that have experience and expertise in podiatry coding, you can ensure an accurate coding process for your practice.

Documentation challenges

Comprehensive and precise documentation of the patient’s condition and the services rendered is the cornerstone of successful podiatry billing. Podiatrists must provide detailed and specific documentation of patient encounters, procedures performed, diagnoses, and medical necessity. Incomplete or inadequate documentation can lead to claim denials, delays in reimbursement, and potential compliance issues. It is essential to document all relevant information, including the patient’s chief complaint, history of the present illness, examination findings, treatment plan, and any other necessary details. As many of the services provided by a podiatrist may not be reimbursable, the determination of medical necessity and validation of coverage are critical to getting reimbursed optimally. For example, to bill for nail debridement, it is essential to furnish supporting documentation that demonstrates the necessity of the debridement procedure. Adoption of an advanced EHR system promotes a standardized and streamlined documentation process. This helps to capture all relevant details accurately and ensure the consistent quality of patient records.

Insurance coverage

Most health insurance companies cover medically necessary podiatry treatments. However, cosmetic procedures such as the cutting or trimming of toenails will not be paid for by insurers. Podiatry practices primarily treat the elderly, which necessitates additional efforts in billing and coding, as this population is covered by Medicare. Private insurance companies, Medicare, and Medicaid may have specific policies and guidelines for podiatry services. Medicare coverage system is divided into Part A, for inpatient stay services and Part B, for outpatient care. For medically necessary treatments, Medicare covers 80% of the cost once the beneficiary meets the deductible. The remaining 20% of the co-insurance is paid by the patient. Understanding these policies, verifying coverage, and ensuring proper documentation to support medical necessity can be challenging. Reimbursement rates for podiatry services may also vary, and coders need to be knowledgeable about different insurance plans to optimize reimbursement.

Appeals

Claim denials are an unavoidable part of any specialty, including podiatry. So, a proactive approach to addressing and monitoring the denied claims is crucial for podiatrists to receive justified payments. Denials can occur due to coding errors, insufficient documentation, or insurance company policies. Resolving denials and navigating the appeals process can be time-consuming and require knowledge of insurance policies and regulations. It is imperative to have an effective appeal process to overturn denied claims and obtain reimbursements.

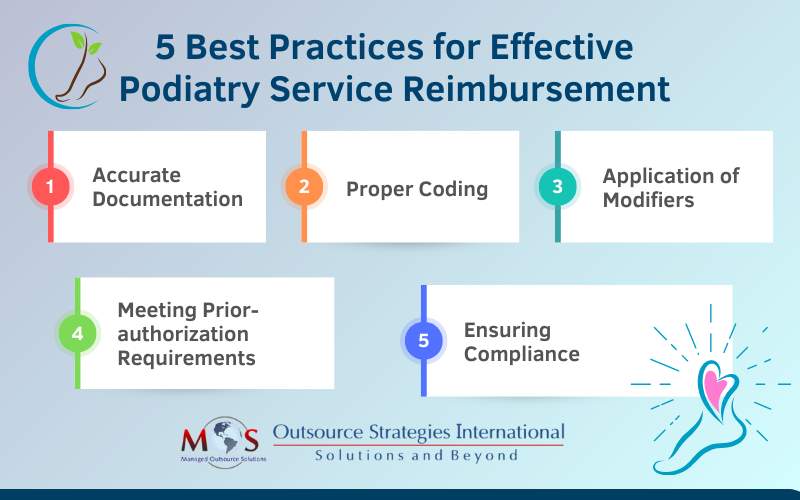

Best Practices for Maximizing Podiatry Practice Reimbursement

Accurate documentation

Keeping accurate documentation for the podiatric services you provide is the foundation for a successful billing practice. The medical document should contain all the necessary patient data, such as the chief complaint, history of the present illness, examination findings, treatment plan, and any other relevant information. Comprehensive documentation not only aids in the correct coding process, but also establishes medical necessity. To promote a standardized documentation process, implementing EHR systems ensures consistency and an overall improved quality of patient records. Proper coding Like any other specialty, podiatry services have precise coding criteria that coders must meticulously select to accurately describe the patient’s condition. The usage of the right codes is crucial as they directly impact the payment, and any inaccurate code will lead to claim denial. Medical coders also have to ensure that they adhere to the coding guidelines set by organizations such as the AMA and CMS. Awareness of the latest coding updates and revisions is essential to ensure compliance and maximize reimbursement. The key podiatry CPT codes integral to podiatry medical billing services are: In-clinic Services: Codes for office visits, diagnostic testing, and treatment modalities.

- 99203 – 99204 Office Visit New Patient Level 3 – Level 4

- 99213 – 99214 Office Visit Established Level 3 – Level 4

- 20550 – Injection tendon sheath/ligament

- 29405 – Apply short leg cast (non-weight bearing)

- 29500 – Apply long leg cast (non-weight bearing)

- 58550 – Cryotherapy of skin lesion(s)

Paring or Cutting Procedures on the Skin: Procedure for removal of non-cancerous raised patches of skin

- 11055 – Paring or cutting of benign hyperkeratotic lesion; single lesion

- 11056 – Paring or cutting of benign hyperkeratotic lesion; 2 to 4 lesions

- 11057 – Paring or cutting of benign hyperkeratotic lesion; more than 4 lesions

Nail Care and Nail Procedures: Specific codes for routine nail care and surgical procedures.

- 11720 – Toenail trim (1 foot)

- 11721 – Toenail trim (2 feet)

- 11730 – Debridement of nail(s)

- 11731 – Debridement of nail(s), with partial nail avulsion

- 11740 – Total nail avulsion

Orthotics: Codes related to the prescription and fitting of orthotic devices.

- L3020 – Custom orthotic materials (OR002)

- L3030 – Custom orthotic materials (OR003)

- L3040 – Custom orthotic materials (OR004)

CMS finalized new codes for lymphedema compression treatment effective since January 1:

- A6552 – Gradient compression stocking, below knee, 30-40 mmhg, each

- A6554 – Gradient compression stocking, below knee, 40 mmhg or greater, each

- A6583 – Gradient compression wrap with adjustable straps, below knee, 30-50 mmhg, each

HSPCS codes J1020, J1030, and J1040 have been deleted as of April 1, 2024. Instead, these should be replaced with 4 units of HSPCS J2919 for every one unit typically billed for HSPCS J1020. Outsourcing to providers of podiatry medical billing and coding services ensures correct usage of the latest podiatry codes and compliance with the coding guidelines for prompt payments.

Application of modifiers

Podiatry coding can be complex because multiple procedures are often performed on the same organ or structure, resulting in the use of numerous billing codes for reimbursement. The use of appropriate modifiers is necessary to provide additional information about the procedures performed. “Q” modifiers are used in podiatry billing to denote various classes of findings, such as

- Q7 – One class A finding

- Q8 – Two class B findings

- Q9 – One class B and two class C findings

These modifiers may be used with procedure codes 11055, 11056, 11057, 11719, 11720, 11721, or G0127 and indicate the patient’s condition in their findings. Including modifiers ensures the best chance for approval of claim submission, as they signify that the procedures performed were not routine. For example, CPT code 11721 (Covered Nail Debridement 6 or more) requires a Q8 modifier (for routine check-up) with systemic conditions. This is medically necessary to be covered by Medicare up to six times a year. When multiple surgeries are performed, it is important for the coder to indicate payable modifiers, such as the ten-digit toe modifiers (TA-T9) or the left or right modifiers (LT and RT), before the Q range of modifiers. However, for the CPT codes 97598, 11720, and 11721, toe modifiers are not applicable, and the usage of modifiers results in claim denial. It should be noted that overuse of modifiers is an issue that could produce claim denials. So, it is the provider’s responsibility to document these findings in the patient’s record. Failure to provide supporting documentation for the use of Q modifiers on any claim may result in a denial of that claim.

Prior authorization requirements

Another crucial component of podiatry billing is the knowledge of prior authorization requirements of different insurance plans to ensure timely approval and minimize potential reimbursement issues. Podiatry practices must implement robust insurance verification processes to discover any pre-authorization requirements. For 2024, effective since August 12, the code L1951- Ankle foot orthosis, spiral, (institute of rehabilitative medicine type), plastic or other material, prefabricated, includes fitting and adjustment, requires prior authorization. However, it should also be noted that most podiatry services (Medicare, Medicaid, and commercial) will not require an authorization. The following services will require authorization (when they are rendered in an office setting) since they are not exclusively in the realm of podiatry:

- Certain injections for pain management

- HBO therapy

- Physical therapy

If a podiatrist renders services in a hospital, ASC, home, or other POS, it would be advisable to verify if precertification is required.

Compliance consideration

The regulatory guidelines of healthcare are subjected to frequent changes in podiatry billing, coding, and coverage policies. Podiatrists must stay abreast of the latest developments in the podiatry billing process at the federal and state levels. Staying current with updates to Medicare and Medicaid policies, as well as payer-specific guidelines ensure patient care is in compliance with quality standards. This includes proper documentation, accurate coding, and adherence to billing and coding rules. Non-compliance can lead to penalties, fines, and reputational damage. Conducting regular audits can help identify any potential compliance issues, such as coding errors, documentation deficiencies, and other areas of non-compliance. It is necessary to address any issues promptly, implement corrective measures, and stay up-to-date on changes in billing regulations and guidelines to ensure ongoing compliance. Managing a podiatry practice is an arduous feat that has challenges with patient care, awareness of the latest podiatry billing and coding guidelines, and insurance policies. Navigating these challenges with strategic decisions and implementing best practices in podiatry billing is essential for the financial success of a podiatry practice. Strategies to consider include investing in ongoing training and education for coders, implementing effective documentation improvement programs, and leveraging technology and software solutions for coding and billing. Practices can also consider utilizing outsourced podiatry medical billing and coding services. Partnering with an expert can help practices optimize their billing operations, avoid denials, increase revenue, and pave the way for sustainable growth.