Claim denials can be a major source of frustration and financial strain for healthcare providers, increasing the significance of reliable medical billing services. Reports indicate that denials are rising. In December 2023, Fierce Healthcare reported on two analyses which found an increase in denial rates. One of the studies found an increase in overall initial denial rates from 10.15% in 2020 to 11.2% in 2022, and then up again to 11.99% in the first three quarters of 2023.

Denied claims mean delayed payments, increased administrative work, and potential revenue loss for your practice. The good news is that there are proactive steps you can take to minimize claim denials and streamline your medical billing processes. From ensuring accurate patient information to optimizing your coding and documentation, let’s explore some effective techniques that can get your claims paid faster and improve your overall financial performance.

Understand the Reason for Claim Denial

The first step to reducing denials is understanding why they occur. Here are the common reasons for claim denial:

- Incorrect demographic information: Errors in patient name, subscriber/referral number, or date of birth can lead to denied claims.

- Lapsed or terminated insurance coverage: Expired or withdrawn patient insurance can result in claim denials.

- Diagnosis-procedure mismatch: Procedures not medically necessary per the diagnosis may be denied.

- Incorrect coding: Ensuring the right codes are used for each service is crucial.

- Non-covered benefits: Claims for benefits not included in the patient’s policy will be denied.

- Lack of prior authorization: Insurers often require prior authorization before services are rendered.

- Missed filing deadlines: Claims filed after the stipulated timeframe will be denied.

Payers use specific claim adjustment reason codes (CARC) and understanding them is critical to know why the claim was denied. For example, CO-4 indicates: “the procedure code is inconsistent with the modifier used or a required modifier is missing. Resubmit the claim with the appropriate modifier for the procedure.” It’s crucial to stay on top of denial codes and insurer communication and statements to identify why a claim was not paid.

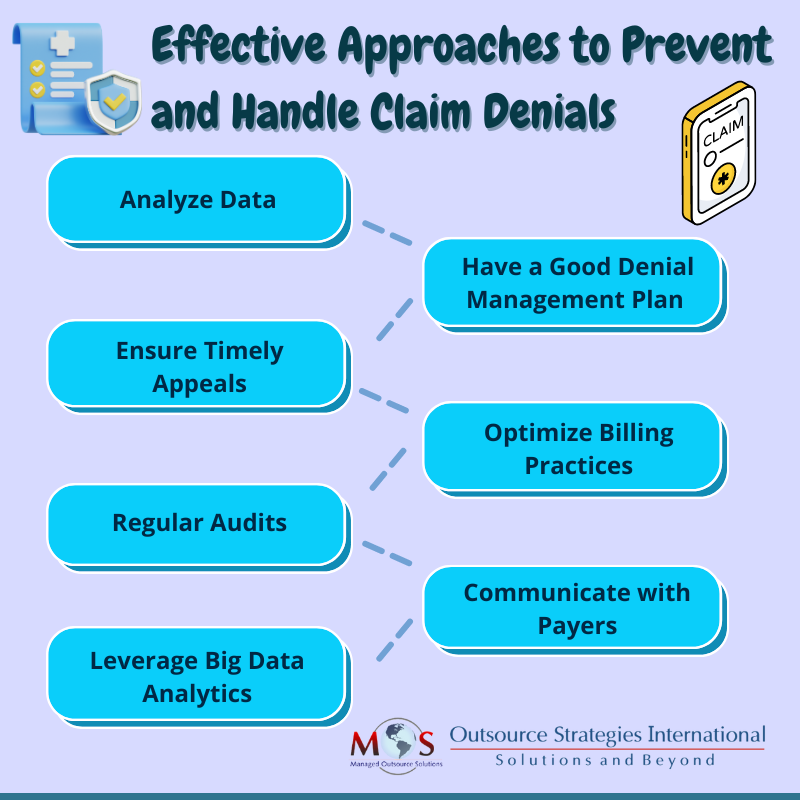

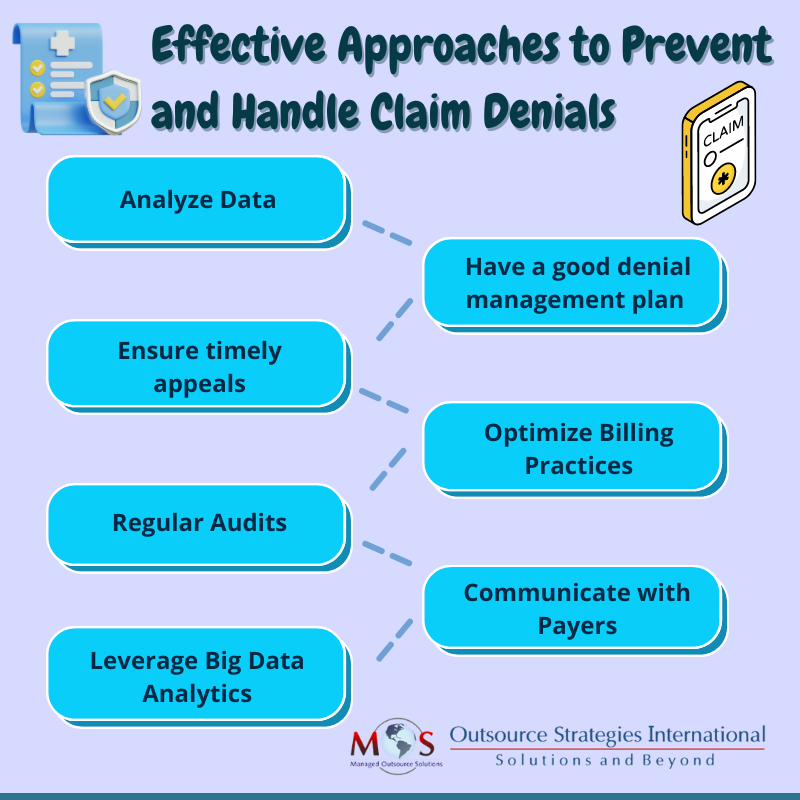

Proactive Strategies to Manage Claim Denials

- Analyze data to identify the source of the error: It’s essential to track denials by volume, type, payer, and reason to understand the trigger points by frequency. Track details such as percent of claims denied on initial submission, time lag between date of denial received and date the appeal was sent out, and percent and dollars of reworked claims that are paid and those that are written off. This can help you identify the source of the error that led to the denial – whether it is human, due to workflows, technology, or data. Claims can also be rejected to changes in payer policies. Continuous monitoring and audits can identify the source of the errors so that they can be corrected quickly to prevent future denials.

- Denial management: Have proper denial management strategies in place. Maintain a log of denied claims to identify patterns and common issues. Create a structured, organized workflow is to manage each type of denial. This can speed up the handling of denial management. For instance, all coding-related queries can be routed directly to medical coders for assessment and action. As most payers have specific requirement and time limits for claims resubmission, it is important to keep these aspects in mind while resolving issues and resubmitting claims. Depending on the payer’s rules, rationale for payment may have to be submitted in writing. Proper documentation of the service rendered, pertinent medical literature and sections from the CPT code book can be submitted to support resubmitted claims.

- Appeal: Develop a structured process for appealing denied claims promptly. There are three options to respond to a claim denial:

- Appeal. It is recommended to develop appeal letter templates for the most common denial reasons. Scan documents such as operative reports and office notes and attach them to the appeal letter.

- Respond to the payer’s request by supplying additional information or correcting invalid entries.

- Bill the next responsible party, the second insurer or the patient or guarantor.

- Optimize billing practices: Submit claims promptly to avoid delays. Establish a follow-up procedure for pending claims and overdue payments. Take proactive steps to prevent denials. Make sure claims are submitted with accurate patient information. Verify insurance coverage to confirm patient insurance details and coverage before the office visit. This requires checking demographic information and insurance details. To ensuring up-to-date information, patients should be asked about changes in coverage and other relevant details at each visit.

- Regular audits and reviews: Claims scrubbing or auditing is a crucial denial prevention strategy. Audits can detect and eliminate coding and billing errors so that they can be addressed before they are submitted to the payer. Conduct regular internal audits to identify and correct common errors. Another option is to have a medical billing company provide an objective review of your claims processes.

- Communicate with payers: Stay updated on payer-specific guidelines and policies to avoid errors in claim submission. For appealing claim denials, it is critical to know the payer contracts as well as patient’s coverage-benefit plan design. Schedule regular meetings with payer representatives to address issues and stay informed about changes.

-

- Leverage Big Data Analytics

According to reports, hospitals are already using AI applications and big data analysis in the areas of insurance pre-certifications, denial prediction, and ICD-10 billing code verification.

Big data analytics can:

-

- Simplify and improve accuracy in the medical billing process by identifying medically necessary and completed procedures

- Find data patterns such as causes of insurance claim rejections as well as strategies to follow

Help reduce incorrect insurance claims filed and increase practice revenue - Reduce medical errors and eliminate duplication of tests or procedures, leading to reduced claim rejections

Data analytics can also help identify margins for ancillary services, help the provider make and execute better, data-driven decisions, and analyze which value-based contracts will yield the best returns.

Get Expert Support

Whether you’re a small private practice or a large healthcare organization, these tips can help you navigate the complex world of medical billing and maximize reimbursement for your services.

However, there’s much more to this challenging process of preventing denials. Complex criteria and varying requirements in payer contracts complicate prevention even further. Payers are also implementing advanced methods to identify inaccuracies and reject claims. These challenges make it more difficult for providers to submit accurate claims. That’s why getting expert assistance is highly recommended to win the battle against claims denials.

Partnering with an experienced medical billing company is the best option when it comes to claims management. Their professional team stays up to date on payer rules to ensure accurate claim submission. With timely review of denial and audit data and ongoing communication with payers, an expert can help you minimize errors that lead to denials.