Even as you provide the best possible care for your patients, paying close attention to the financial aspects of your practice is necessary to avoid medical billing errors that can impact your bottom line. As a complex process involving multiple payers, numerous medical codes, and varying state regulations, medical billing can pose significant challenges. Most healthcare providers rely on outsourced medical billing services to prevent errors, streamline claim submission, improve the revenue cycle, and enhance overall practice efficiency. Experts can handle all aspects of the billing process, boosting the financial stability of your practice and patient satisfaction.

Outsource medical billing to us.

Enhance cash flow as you focus on patient care!

Call (800) 670-2809 Now!

Importance of Accurate Billing

Mistakes in billing can impact providers, payers and patients.

The medical billing process involves many steps from patient registration and eligibility verification to coding, claim submission, and payment collection. Even a small error in any of these steps can lead to denials and disrupt your practice’s revenue cycle. Incorrect billing can lead to allegations of fraud, resulting in legal consequences and penalties. Accurate and transparent billing practices boost patient trust and satisfaction, contributing to the success of your practice.

Inaccurate billing information can lead to denials, delays, and underpayment. When your practice submits clean claims, insurance companies can process them smoothly.

Errors in bills cause financial distress for patients and can result in costly disputes. Accurate billing ensures that patients pay only for the services they received.

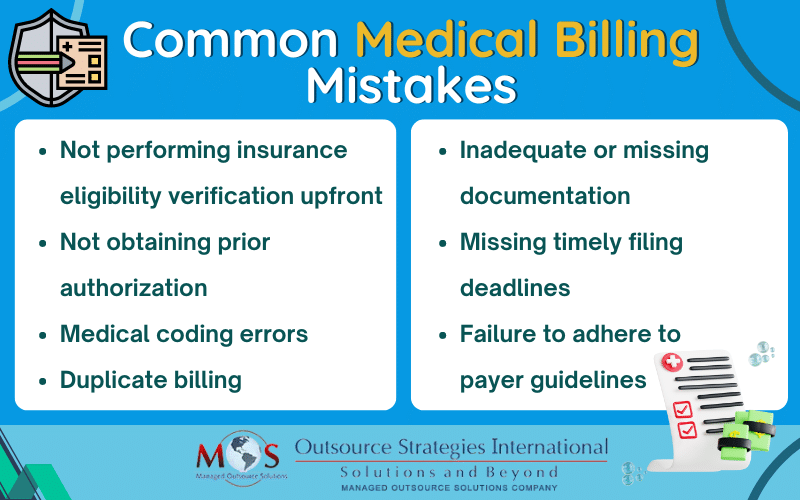

7 Common Medical Billing Mistakes

Not performing insurance eligibility verification upfront

One of the most common reasons insurance companies deny claims is missing or incorrect patient information. This includes, but is not limited to, a mistake in the spelling of the patient’s name, date of birth, digits in their policy number or group plan number or insurance coverage.

Best practice to avoid this problem is to verify all patient information before submitting a claim. Many practices rely on professional insurance verification services to ensure that all necessary information is correct before services are provided.

Not obtaining prior authorization

Certain medications, diagnostic tests, procedures, or medical equipment require prior authorization. It is necessary to complete the prior approval process before moving forward with treatment. If approval is not obtained before providing care, the insurance company will deny the claim.

Medical coding errors

Medical coding errors include using incorrect diagnosis or procedure codes, upcoding (billing for a more expensive service than performed), or unbundling (billing separate codes for services that should be billed together). Submitting mismatched diagnosis and treatment codes is another common error. Also, codes get updated and sometimes may be changed or outright deleted. Using outdated codes can lead to underbilling or overbilling.

These errors result in claim rejections or underpayment and audits. To prevent inaccurate billing and potential legal issues, it is important to ensure that the codes assigned accurately reflect the symptom, diagnosis or treatment documented.

Duplicate billing

This refers to submitting multiple claims for the same procedure. Billing departments may re-file claims without allowing sufficient time for insurance company to process the original claim. Claims for multiple and/or identical services provided to an individual patient on the same day may also be denied as duplicate claims. Though it can happen inadvertently, insurers tend to regard duplicate billing as a fraudulent practice.

Reliable medical billing services review all claims carefully before submission to ensure that they are not duplicates. They will also ensure that identical services repeated are submitted using CPT modifier 76, 77, or 91.

Inadequate or missing documentation

“If it is not in the medical records, it did not happen.” If the healthcare provider does not provide sufficient documentation, the claim may be denied. Examples include:

- missing or incomplete patient charts

- lack of evidence of medical necessity

- diagnosis code linked does not justify the procedure code

- not providing detailed procedure notes, or incomplete medical history documentation

- Inadequate records that lack crucial details such as the patient’s medical history, reason for the visit, or services rendered.

Lack of proper records make it a challenge to accurately code and bill for services, resulting in errors. If the documentation does not accurately reflect the services provided, it can lead to claim denials or audits.

Missing timely filing deadlines

Not submitting claims within the required timeframe is another common billing error that can lead to claim denials or reduced reimbursement. Each insurance company has its own filing deadline, which is usually outlined in the provider’s contract with the insurer or in the policy documents. The timely filing limit typically ranges from 90 to 180 days from the date of service. Medicare’s timely filing limit is 365 days. Understanding and adhering to the specific timelines set by payers is crucial to avoid denials and delays.

Failure to adhere to payer guidelines

Different insurance payers have specific billing guidelines and requirements. Not complying with these guidelines is a billing error that will lead to claim denials. Being knowledgeable about major insurance providers’ policies, guidelines, and fee schedules can ease your billing process and ensure that you receive correct and timely reimbursement.

Auditing and monitoring medical documentation, billing, and coding practices on a routine basis is crucial to minimize billing errors. Industry and payer guidelines change frequently, and it is important for your practice to stay up-to-date on these changes in order to ensure proper documentation and accurate coding and billing. Partnering with an experienced medical billing company is a practical strategy to achieve compliance within your practice and maximize reimbursement.