In the complex world of healthcare reimbursement, adherence to stringent regulations is not just a recommendation but a fundamental requirement. The Anti-Kickback Laws are a critical cornerstone in the field of medical billing. Navigating this complex terrain and ensuring anti-kickback law compliance is paramount for healthcare providers and professionals. This article explores the nuances of the Anti-Kickback Law, offering comprehensive insights and practical strategies to help healthcare providers navigate these regulations confidently while upholding integrity and ethical standards in medical billing.

When billing for services provided to their patients also, providers must be compliant with billing regulations and ensure that they are assigning the medical codes on the claims in keeping with the actual documentation. Otherwise it could amount to fraud and abuse, and associated hassles. The best way for providers to avoid such concerns is to hire the services of a professional medical billing company. These professional medical billers ensure that all claims are manually reviewed for errors before they are submitted to insurers. They will make sure that there is no duplicate billing or issues such as upcoding, coding for medically unnecessary services, and so on.

The AKS is a federal criminal law that prohibits offering or accepting kickbacks to generate health care business.

Understanding Anti-kickback Regulations

The federal Anti-Kickback Statute (AKS) is a criminal statute. AKS was enacted by Congress in 1972 and has been subsequently amended many times. The AKS prohibits anyone from soliciting or receiving “remuneration” of any kind in exchange for referring a patient for services or for purchasing an item or service paid for by a federal healthcare program such as Medicare and Medicaid. Many states have their own anti-kickback laws which apply to medical providers and entities participating in their Medicaid programs.

Streamline your medical billing processes while ensuring anti-kickback law compliance!

What is “Remuneration” under the AKS?

The Anti-Kickback Statute defines “remuneration” as anything of value in order to induce recommendations and medical referrals. Here are some examples of possible remuneration prohibited under the Anti-Kickback Statute:

- Cash transactions

- Speaker fees or overcompensation for roles like directorships, indirectly tied to referrals

- Stock options or shares as inducements

- Rent offered at reduced or no cost

- Advertising space provided for free or at a reduced rate

- Costly hotel accommodations or meals

The AKS defines “remuneration” as anything of value in order to induce recommendations and medical referrals.

Who does the AKS Statute apply to?

The specific groups of people that the federal Anti-Kickback Statute prohibits providing financial rewards are physicians, marketing/advertising/sales staff, patients, and office administrators or procurement staff. Kickback schemes often target physicians because they are authorized to refer patients to other healthcare providers and suppliers. As a physician, you determine the medications your patients use, the specialists they consult, and the healthcare services they receive. As numerous individuals and companies seek your patients’ business, they might offer payment in exchange for patient referrals.

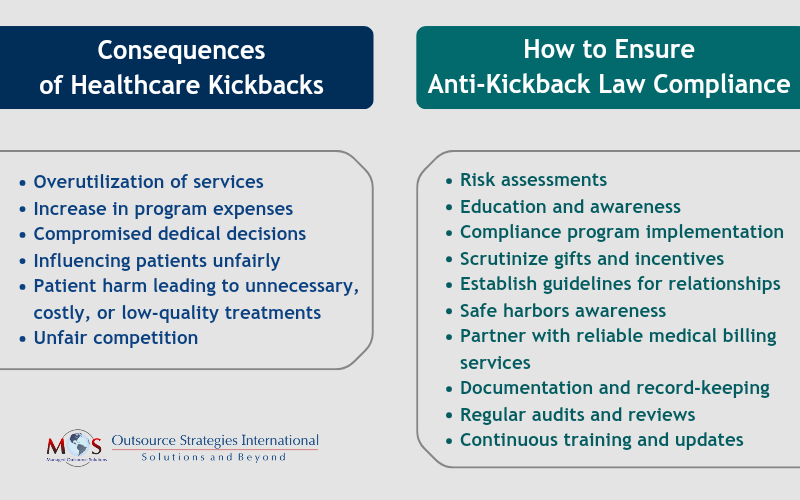

What are the consequences of kickbacks in healthcare?

Medical decisions driven by kickbacks lead to:

- Excessive use of services

- Rising program expenses

- Compromised medical choices

- Directing patients unfairly

- Patient harm, resulting in unnecessary, costly, or poor-quality treatments

- Unfair competition

Reach out to us today to optimize your billing practices and safeguard your organization’s integrity!

The AKS aims to protect the integrity of government healthcare programs by curbing these influences.

Safe Harbors: Exceptions to the AKS

The Office of the Inspector General (OIG) which is responsible for enforcing anti-kickback law compliance has established several Safe Harbors or exceptions to the AKS. These are expanded yearly. The following list provided by the American College of Physicians (ACP) represents some Safe Harbors currently in effect:

- Ambulatory surgical centers

- Discounts

- EHR items and services

- Electronic prescribing items and services

- Equipment rental

- Health centers

- Investment interests

- Payments made to bona fide employees

- Personal services and management contracts

- Practitioner recruitment

- Referral services

- Space rental

- Warranties

Best Practices for AKS Compliance in Healthcare

Violating the AKS can lead to severe consequences. Individuals may face up to 5 years in prison and a $25,000 fine. Civil penalties of up to $50,000 may apply under the Civil Monetary Penalties Law. Moreover, convicted healthcare providers could face exclusion from future Medicare and Medicaid program coverage.

Understanding anti-kickback regulations and implementing processes and systems to maintain compliance can help you avoid violations. Here are 6 best practices to navigate the complexities of AKS regulations.

Risk assessments: Doing risk assessments will help you stay compliant across your organization. Finding possible issues lets you fix them before they cause trouble for your organization, staff, or patients. For instance, spotting and fixing problems in how you disclose conflicts of interest can stop you from breaking the AKS.

Educate yourself: Know the risk factors tied to the Anti-Kickback Statute (AKS) in healthcare. Understand AKS violations, like improper financial deals or kickbacks, to identify and fix compliance issues. Familiarize yourself with situations that might cause AKS violations, such as taking rewards for patient referrals. Take proactive steps to prevent these. This knowledge helps your healthcare organization follow AKS rules, avoiding legal problems and ensuring ethical practices in healthcare. Additionally, stay updated on any changes in regulations or best practices.

Implement an AKS compliance program: Developing and implementing a compliance program can mitigate the risks associated with AKS violations, uphold integrity in their operations, and safeguard against legal repercussions. This implies having robust policies and procedures in place to prevent and detect potential AKS violations within your organization.

Scrutinize gifts and ensure they are legitimate: Record all non-monetary compensations provided to providers. Gifts are permissible if they align with organizational guidelines and aren’t accepted in return for referrals to the gift provider, which would breach the Anti-Kickback Statute. To ensure compliance, document the value of each gift received by individual providers and address gifts exceeding thresholds set by both CMS and your organization.

Create protocols and guidelines: Have guidelines in place for managing relationships with healthcare providers and suppliers. Physician practices should also devise strategies to prevent offering improper incentives to patients. Examples of such incentives include offering cash or financial rewards to patients in exchange for choosing specific healthcare services or providers; giving patients free services or waiving fees in exchange for choosing a specific healthcare provider or facility, and offering discounts or special deals to patients contingent upon their selection of certain healthcare treatments or providers.

Be aware of several safe harbors to the federal anti-kickback statute: The safe harbors are specific arrangements or practices that, if structured appropriately, are not considered violations of the AKS. Awareness of safe harbors allows you to structure their business relationships or practices in a way that complies with federal regulations, reducing the risk of inadvertently violating the law.

Boost Compliance: Partner with a Reliable Medical Billing Company

Medical billing services play a critical role in anti-kickback law compliance within healthcare. These services handle financial transactions and claims submissions, making them crucial for ensuring that billing practices align with anti-kickback regulations. By maintaining transparency and accuracy in billing, medical billing services, contribute significantly to upholding the ethical standards outlined in anti-kickback laws. Dedicated service providers also ensure that there are no discrepancies or errors in the medical claims submitted to health insurers. In this way, healthcare providers can steer clear of any possible fraud or abuse of the healthcare system.