Maintaining and navigating health insurance is crucial for patients to pay for their hospital visits, surgery, and other serious issues. Likewise, to improve collections and make the best decisions for their patients, physicians too need to understand different types of health insurance terminologies such as copays, coinsurances, and deductibles. Medical billing companies provide insurance verification and authorization services to help physicians identify patient benefits before the scheduled medical office visit.

What is a Deductible?

The deductible is the total amount patients must pay out of pocket before each year for covered health care before their health plan begins to pay. Patients are 100% responsible for all of his/her medical costs until they reach their deductible. For e.g., if the patient’s deductible is $2000, the health plan will not pay only after the patient has spent $2,000 on services that are subject to the deductible.

Key points about deductibles:

- Not all services apply to the deductible.

- Some plans pay for services like a checkup or disease management program before the patient meets the deductible

- Some plans have separate deductibles for certain services (for e.g., for prescription drugs).

- The deductible amount can vary depending on whether the patient gets health care outside of the network or from a physician in the plan’s network.

- Usually, premiums are lower for plans with higher deductibles and higher for plans with lower deductibles.

- Even after the plan’s deductible has been met, the patient may still owe a copay or coinsurance amount for each visit.

- Family plans usually have both an individual deductible, which applies to each person, and a family deductible, which applies to all family members.

After the deductible is met, the patient will share the cost with their plan by paying coinsurance.

What is Coinsurance?

Coinsurance is the percentage of the medical expense the insured person and the insurer each pay for services covered by the plan. For example, if a health plan has an 80% / 20% coinsurance, this means that the insurer will pay 80% of the allowed health care expenses and the patient will pay 20%, which is the rest of the allowed amount.

Coinsurance amounts will vary from visit to visit based on the type of services that the patient receives. Suppose the insurance plan’s allowed amount for an office visit is $200 and the patient has already met his or her deductible. If the coinsurance is 20%, the patient would owe $40 at the time of service.

Both coinsurance and copayment are cost-sharing provisions, but copays require the patient to pay a set dollar amount at the time of the service. With coinsurance, the patient must pay the deductible before the insurance plan will cover its 80% share of the medical costs. If a patient has Medicare as primary insurance as well as secondary insurance, Medicare would cover most of the healthcare bills first. The secondary payer would be responsible for the remaining costs such as copays and coinsurance.

What is a Copay?

A copay or copayment is the fixed dollar amount that the patient pays a healthcare provider at the appointment. The health insurance company will pay part of this cost and the patient will pay the rest. Copays can vary for different services within the same plan. The common medical services that may require copays are:

- Primary care office visits and specialist visits

- Urgent care visit

- Emergency room visit

- Prescriptions

Copays differ among health plans and this fixed fee is usually paid before deductible has been reached.

Here’s an example of how co-pays work: A patient visits his/her primary care physician. If the health insurance plan’s allowable amount for this office visit is $100 and the copay is $20. The $20 is the fixed amount that the patient pays at the time of the visit after the deductible has been paid. Plans with lower monthly premiums usually have higher copayments than plans with higher monthly premiums.

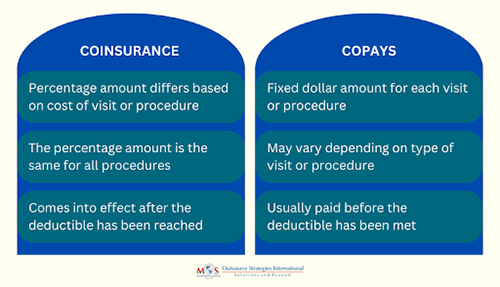

Differences between Coinsurance and Copays

The out-of-pocket maximum is a cap, or limit, on the amount of money the insured has to pay for covered health care services in a plan year. Deductibles, copays, and coinsurance count toward the out-of-pocket maximum. If a patient’s health plan has a $5,000 out-of-pocket maximum for the plan year, the plan will begin to pay 100% of costs of the covered care after out-of-pocket maximum has been met.

A Healthcare.com survey reported that medical debt is a growing burden among Americans, with more than 1 in 3 U.S. adults carrying a balance. As all of the specifics of patients’ insurance plans impact practices, it’s important that physicians understand the nuances of patients’ coverage to know how much they should collect from each patient at the office visit. Partnering with an experienced insurance verification company is the best solution. Insurance verification specialists will collect the correct information from each patient at the office visit, which will help providers understand what their plans cover, educate patients about their health coverage, and submit clean claims.