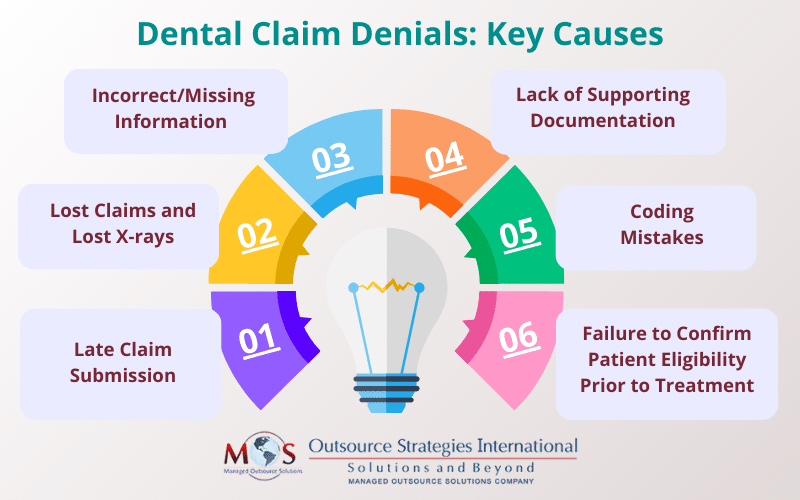

Claim denials are among the main concerns reported to the American Dental Association by dental offices. With complex procedures, rules, and intricate claim submission processes, dental billing can be a challenging and error-prone process. Rejected claims can badly affect a dental practice’s finances. While expert dental billing services can take the pain out of the task and improve revenue flow, it’s important that providers know the common reasons why dental claims are delayed or denied.

This post discusses the leading causes of dental claim denials and provides tips to prevent them.

Our dental billing services can optimize your dental billing process and revenue!

Primary Reasons for Dental Claim Denials

Incorrect/Missing Information

Lack of sufficient information or data errors is the most common reason for a delayed or denied claim. The dental claim should have accurate dental patient information as well as their all of their insurance information. In addition to personal data such as full name, birthdate, address, ID number, and the date of service, the claim form should have the treating dentist’s information, including name, address, license number, and tax identification number (TIN, EIN or SSN). If the claim is returned with the remark “beneficiary identification incorrect”, it means that the name and/or the enrollee’s ID number on the claim are wrong.

Lack of Supporting Documentation

Insufficient supporting documentation is another common reason why dental claims are sent back. Attached documentation on a dental claim comes in the form of clinical chart notes, x-rays, intraoral photos, operative reports, exam forms, specialty referral forms, orthodontic indices, dental history, periodontal charting, narratives, pathology reports, and anesthesia records.

Delta Dental explains that the main reasons for the frequent denial of claims for periodontal scaling and root planning (SRP) is because the submitted documentation does not support payment of SRP. For SRP claims, the supporting documentation should include a narrative indicating periodontal disease, diagnostic quality radiographs showing bone loss and a complete periodontal chart that includes documentation on at least 6 sites around each affected tooth/ implant (ADA).

All submitted documentation must be legible. Submitting x-rays of charts that are unclear and difficult to read can get your claim denied. It is also advisable to provide more information (rather than less) about what was done in regard to treatment when filing a dental claim. Certain procedures have specific documentation requirements. If you are unsure about what to include, it’s advisable to contact the insurance company and clarify matters. This can help prevent claim denial due to missing documentation.

Lost Claims and Lost X-rays

A major complaint with regards to third-party claim payment is lost claims and lost X-rays, according to the ADA. Dental offices often send claims or X-rays several times before the payer will acknowledge receipt. Though X-rays are submitted with the claim, the dentist will receive an explanation of benefits (EOB) requesting the X-rays. The lack of standardization for attachments from carriers and the inability to reference attachment requirements for multiple carriers in a central location is the main reason for the confusion. The ADA recommends that each office contact each carrier individually to determine claim processing requirements.

Coding Mistakes

ICD-10 codes, CDT codes and CPT codes play a fundamental role in dental insurance claims. Using the wrong medical codes or outdated, discontinued codes can get claims denied.

ICD-10-CM codes help determine the medical necessity of a dental procedure or service, and an increasing number of payers are requiring diagnostic codes on claims. CDT codes should be used for reporting all dental procedures you perform. For certain procedures, CPT codes can be used to bill the patient’s medical insurance.

Common dental coding errors include incorrect application of the periodontal codes and mistakes in documenting and reporting implant- and abutment-supported crowns. The golden rule is to choose the codes that best represent the treatment provided. Also, stay informed about the types of attachments that each CDT procedure code requires.

Late Claim Submission

Every health insurance company has its own deadlines for claim filing. Claims that are filed outside of the policy’s time limit are denied.

To enable quick and efficient processing with accurate information, claims should be filed soon after dental services are provided. Insurance companies may deny a claim on the grounds that it was not submitted on time. While some health plans have a one year time limit for claim submission from the date of the service, others may allow only 180 days or even 90 days (for some local union plans). Even if you resubmit the claim, it is likely that it will remain unpaid. Requests for appeals may also be rejected, according to a Dental Economics article.

Patient eligibility was not confirmed prior to treatment

This is related to the previous issue. Claim denials can occur due to insurance coverage issues, such as expired policies, limitations, services not covered under a patient’s plan, etc. Reviewing a patient’s benefits before they enter the office is a key step to ensure insurance claims are not denied. Prioritizing dental insurance verification is an essential step to make sure patient information is up-to-date, their benefits are still active, and how much of the procedure their insurance will cover.

Get Expert Support

Paying attention to these matters before submitting a claim can help prevent delays and denials. Make sure that providing correct information and supporting documents along with your claims. Partnering with a reliable dental billing company is a practical strategy that can save time, effort and money, reduce claim denials, and boost revenue. Experts provide comprehensive revenue cycle management support from patient registration and dental insurance verification services to billing, coding, claim submission and payment collection.

Don’t let dental billing complexities hinder your practice’s growth!

To schedule a consultation

![Dental Insurance Verification: Best Practices for Success [Updated for 2025]](https://www.outsourcestrategies.com/wp-content/uploads/2024/11/dental-insurance-verification-best-practices-for-success-400x250.jpg)