Medical billing is a complex process that involves many phases and managing it efficiently is essential for proper claim submission and appropriate reimbursement from insurance companies. ERA is a critical component of medical billing and healthcare receivables management services, providing healthcare providers with information about the adjudication of claims.

What is ERA?

ERA stands for Electronic Remittance Advice. It is a digital document about a claim payment that is sent by an insurer to a healthcare provider. An ERA explains how a health plan has adjusted claim charges based on factors like:

- Contract agreements

- Secondary payers

- Benefit coverage

- Expected copays and co-insurance

- Capitation payments

Information available in an ERA includes:

- Amount requested

- Contractual amount allowed

- Deductible remaining

- Amount paid

- Reasons for any differences between the billed and paid amounts

- Reasons for claim denial, including denied codes and services

- Patient financial liability applied

- Bundling or splitting of payments

- Payment method, such as check, electronic funds transfer

ERAs replace paper remittance advices or Explanation of Benefits (EOBs), making the payment posting and reconciliation process faster, more efficient, and more accurate. ERA typically works in conjunction with Electronic Funds Transfer (EFT), the process used to transmit healthcare payments from a health plan to a healthcare provider’s bank account. They are transmitted in standardized HIPAA-compliant electronic formats such as ANSI 835.

Looking to optimize your practice’s receivables management?

How ERA Services Work

ERA allows a medical billing company to track, analyze, and manage a practice’s revenue cycle more efficiently, improving both denial management and payment collection processes. Here’s a brief overview of how ERA services work in a medical billing process:

- Claim Submission: The medical provider submits a claim to an insurance company (payer) through an electronic claim submission process.

- Claim Adjudication: The insurance company processes the claim and decides whether it will pay, deny, or adjust the claim.

- ERA Generation: After adjudication, the insurance company generates an ERA in the ANSI 835 format, which includes details like the payment amount, patient responsibility, claim adjustments, or denials.

- Transmission to Provider: The insurance company sends the ERA to the healthcare provider electronically, usually through a clearinghouse or directly to the provider’s practice management system.

- Payment Posting: The medical billing team receives the ERA and automatically posts the payment or adjusts the patient’s account balance. This may include handling co-pays, deductibles, and adjustments.

- Denial and Adjustment Management: If any claims are denied or adjusted, the ERA will include detailed codes and reasons for the denial or adjustment, allowing the provider to address the issue (e.g., resubmitting the claim or appealing the decision).

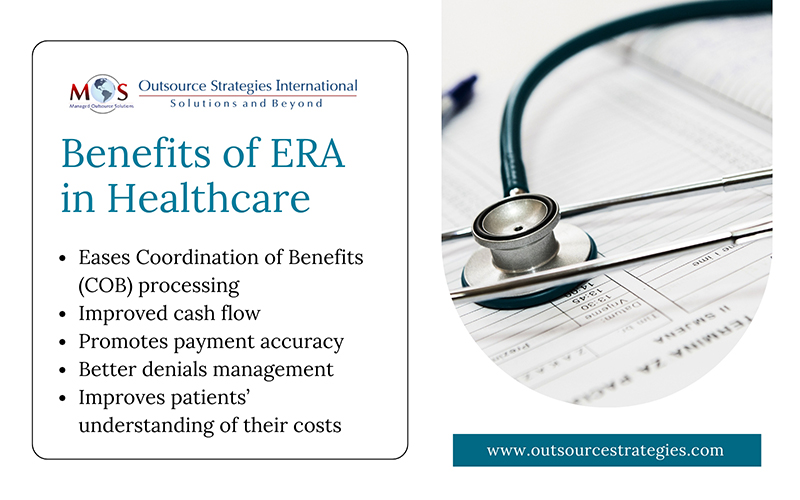

Benefits of ERA

Eliminates costly and time-consuming manual processes: With ERA, practices no longer have to wait for EOB statements to arrive in the mail or to manually enter, verify, and post payment checks. They can ensure uniform ERA processing on their practice management software and post payments and all standard adjustment reason codes to the patient’s account. ERA reduces costs, saves time, and eliminates the risk of misplaced EOBs.

Eases Coordination of Benefits (COB) processing: COB comes into play when a patient is covered under more than one insurance plan. The HIPAA standard electronic claim transactions automate and standardize reporting of the previous payer’s payment and adjustments. ERA eliminates the tedious tasks associated with scanning and attaching paper secondary claims to paper EOBs, facilitates faster secondary billings, and speeds up the revenue life cycle.

Improved cash flow: Electronic processes typically mean faster payments. According to the American Medical Association (AMA), payers reimburse more quickly when physicians use the ERA. This improves cash flow.

Promotes payment accuracy: With ERA, practices can easily identify paid and unpaid claims, step up their collection efforts, reduce denials and improve rate of payment collection.

Better denials management: By enhancing the reliability of payment information, ERA enables comparisons between payers and helps identify issues in claim submissions. This standardization leads to more efficient and effective denial management.

Improves patients’ understanding of their costs: ERAs provide a more detailed breakdown of how payments were applied to a patient’s account, including insurance payments, patient responsibility, and adjustments. This transparency makes it easier for patients to understand their financial obligations. By improving the accuracy, speed, and transparency of the billing process, ERAs help ensure that patients have a smoother, more predictable experience with their healthcare costs and insurance claims.

With the many benefits it provides, ERA reduces many medical billing headaches. However, the AMA points out that, “ERA management will never be 100% automated due to difficult health care business issues”. This implies that there will always be complexities within the healthcare system that require human intervention, preventing complete automation of ERA management due to factors like intricate contract rules, unique patient situations, and frequent policy changes.

Outsourcing medical billing to experts can help practices maximize the benefits of ERA. Medical billing specialists handle everything from helping practitioners in enrolling for ERAs, generating and submitting electronic claims, and managing payments from multiple insurance providers. They also run detailed electronic reports, identify payment discrepancies, and provide support for collections. Partnering with an efficient RCM services provider can reduce administrative costs, streamline billing, and free up valuable time to focus on patient care and support.

Struggling with billing issues?

Our expert medical billing services can take the stress out of your practice.