Preauthorization (P.A), also known as precertification, prior authorization, or prior approval is a mandatory process set by many insurance companies to determine whether the plan(s) cover the prescribed treatment, procedures, medication or equipment. This is to ensure that the particular treatment or service is medically necessary and it falls within the plan’s guidelines. Without preauthorization, the insurer can deny the healthcare provider’s request for coverage, leaving the patient responsible for the full cost of the service.

Reasons for Preauthorization

- Medical Necessity: Insurance prior authorization ensures that the prescribed treatment or medication is absolutely necessary, according to the patient’s health condition.

- Cost Control: By determining the right treatment, insurers can also make sure that the most economical treatment/procedure is chosen, thereby keeping the cost in check.

- Preventive Measure: Prior authorization can help prevent the misuse or overuse of medication, treatment and other related healthcare services.

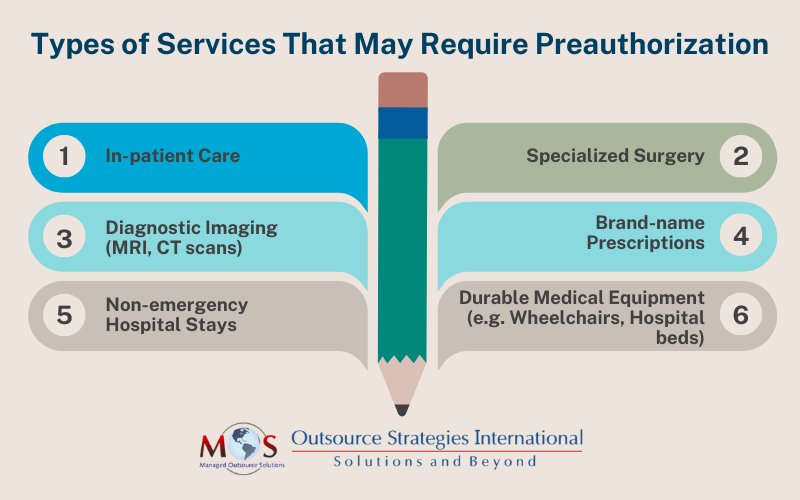

Types of Preauthorization

Preauthorization can vary based on the type of treatment the patient is seeking. There are three common types of P.A:

- Prospective Authorization: This is the most common type, where an authorization is sought before the treatment/medication is administered, to review whether it is necessary for the patient. The provider submits the medical records and the insurer will evaluate and decide regarding the necessity of the prescribed medical procedures.

- Concurrent Authorization: This process is initiated when the patient is currently under treatment in a medical facility and the insurer must review and approve the continuation of care. For example, if the patient receiving treatment has to stay for longer than planned, the provider can seek for an extension via concurrent authorization.

- Retrospective Authorization: This is for those emergency situations where a preauthorization was required but not obtained and the treatment was provided without a review. In this scenario, the insurer will engage a retrospective review to determine whether the treatment was absolutely necessary. This is the hardest to obtain as insurance companies prefer pre-emptive control over treatments.

Steps Involved in Obtaining Preauthorization

- Identify Services Requiring Preauthorization: The first step involves reviewing the patient’s health plan and communicating with the healthcare insurance company regarding the treatment. Make sure the treatment falls under the patient’s plan as insurers scrutinize the information thoroughly. Then, process the request on behalf of the patient at the very earliest.

- Submit the Preauthorization Request: The provider will then have to prepare and submit the request to the patient’s insurer, enclosing relevant supporting documentation such as lab test results, diagnoses, medical records and a written explanation as to why this treatment is necessary for the patient.

- Preauthorization Request Review: The insurance company will review the submitted documents and ensure the prescribed treatment is necessary and covered under the plan. Based on the review, the insurer will either approve or deny the request. This process can take anywhere from a few days to weeks, depending upon the complexity of the case.

- Process the Decision: Once the insurance company has reviewed your request, they will either approve or deny it. If the request is approved, keep note of the authorization code and the approval date. If the request is denied, communicate promptly with the patient and discuss the next steps, including filing an appeal.

Simplify Preauthorization with Our Team of Experts!

Challenges in the Preauthorization Process

Even though preauthorization is mostly a standardized process, it presents several challenges. The common issue that is related to P.A is the delay in care. The process may take days or even weeks, potentially worsening the patient’s health condition in the meantime. Denials present another problem, as in some instances the appeals can be time-consuming and stressful, due to lack of adequate evidence or alternative treatment preferences. Also, the complexity involved with medical insurance policies and regulations make it difficult to comprehend whether a treatment requires preauthorization and which plan it falls under.

Best Practices to Ensure a Smooth Preauthorization Process

Despite various challenges, healthcare providers can ensure a smooth P.A process by following certain steps:

- Prompt Communication: Engage closely with patients in explaining the preauthorization process and the subsequent implications it may have on the overall timeline, so that they will know what to expect.

- Comprehensive Documentation: When the preauthorization submission is made, ensure that all relevant documents are in place and make sure the documentation is exhaustive as it has a better probability of obtaining a swift approval.

- Knowledgeable Staff: Ensure that the medical and administrative team are well-versed in the preauthorization process. Having a trained staff can expedite the process without any delay or flaws right from the onset.

- Regular Follow-ups: Maintain a tracking system to keep in line with the submitted preauthorization requests and do constant follow ups in case of any delay. It can help in avoiding gaps in communication and improve the chances of a prompt result.

- Use Electronic Prior Authorization (ePA) Tools: Nowadays, it is common practice for insurers to maintain ePA tools for healthcare providers to submit and track requests, digitally. Using these can reduce administrative burdens and streamline tasks.

Healthcare providers play the crucial role of being a bridge between patients and insurance companies in making the preauthorization process as smooth as possible for everyone involved. However, the process can be a tiring and time-consuming barrier to the prompt delivery of the required treatment.

According to the American Medical Association’s (A.M.A) 2023 Prior Authorization Physician survey, healthcare organizations complete 45 prior authorization requests per provider, per week. The providers and staff spend an average of 14 hours – almost two business days – completing those requests each week. Among the providers, 88% described the burden associated with prior authorization as “high” or “extremely high.”

The PA process has had a detrimental impact on both providers and patients alike. But, by understanding the ins and outs of the process, staying organized, and proper communication can mitigate delays and ensure patients receive the timely care they need. Therefore, by implementing these best practices, providers can reduce burnouts, enhance employee productivity and overall care delivery.

Maximize Approvals, Minimize Stress: Let Us Handle All Your P.A Hassles!