Efficient and precise medical billing serves as the backbone of seamless healthcare operations, directly impacting the delivery of quality patient care. In addition to providing quality care to their patients, providers need to navigate complexities, formulas and rules associated with medical billing. There are many government regulations impacting medical billing. To traverse this challenging landscape, healthcare organizations need to have a thorough understanding of these regulations and comply with them. Complying with government billing regulations involves stringent adherence to federal and state laws, extensive Medicare and Medicaid guidelines, and meticulous handling of insurance contracts.

Adherence to government billing regulations is not merely a requisite but a safeguard against operational disruptions and legal liabilities. As these regulations are dynamic in nature, constant vigilance and adaptation is essential for compliance and staying abreast of the evolving landscape. Non-compliance can lead to severe repercussions, ranging from claim denials, fines, and penalties to the potential loss of licensure or entanglement in legal proceedings. Healthcare providers can ensure compliance with the dedicated support of a reliable medical billing company that is knowledgeable regarding the various government regulations impacting medical billing. Their medical billing team would follow all coding, eligibility, and documentation guidelines and also manually review the claims, thereby preventing fraud and ensuring proper reimbursement and compliance. For instance, they would make sure that there is no duplicate billing or issues such as upcoding or high-level coding that could prompt an audit.

Let’s take a look at the impact of regulations on healthcare billing.

Streamline your medical billing practices while ensuring compliance

Government Rules and Regulations in Medical Billing

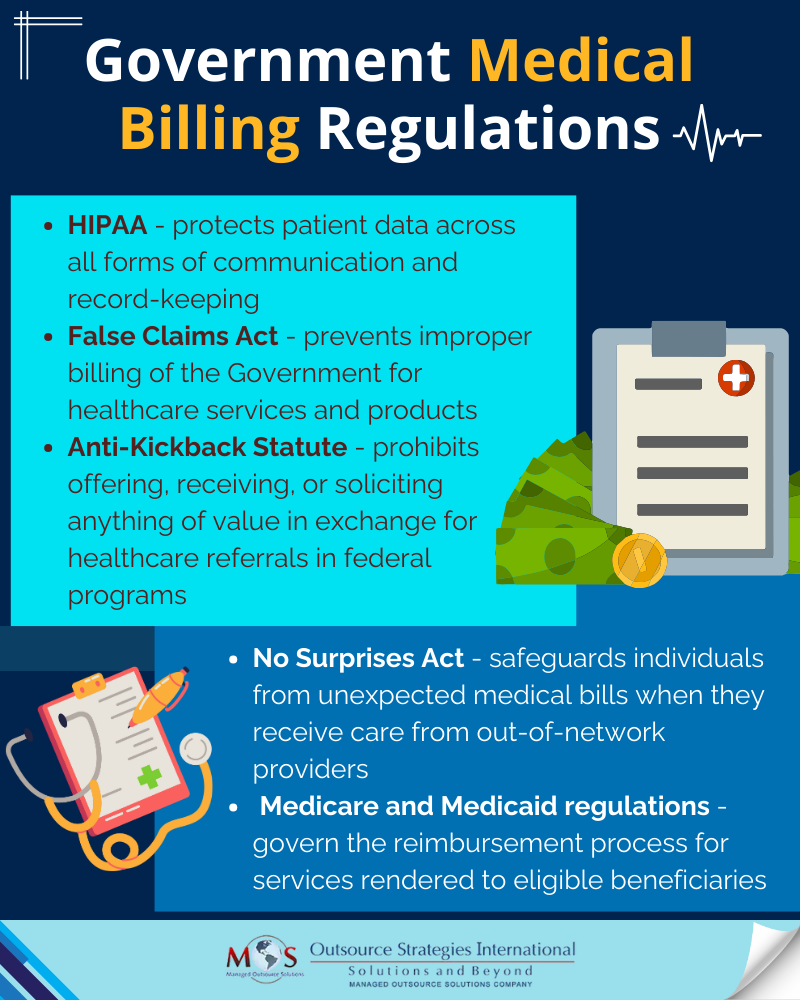

The legal requirements for medical billing practices mandate compliance with several federal laws. These regulations include the Health Insurance Portability and Accountability Act (HIPAA), No Surprises Act, The False Claims Act, the Anti-Kickback Statute, and Medicare and Medicaid guidelines.

HIPAA

HIPAA ensures that protected health information (PHI) is handled with the highest standards of security throughout all stages of the medical billing process. HIPAA consists of two fundamental regulations: Privacy and Security. Securing patient information in billing necessitates compliance with the Privacy Rule, governing oral and written communications, and the Security Rule, specifically focusing on electronic transactions. Complying with these rules ensures comprehensive protection for patient data across all forms of communication and record-keeping.

The False Claims Act

The False Claims Act sets rules and consequences to prevent improper billing of the Government for healthcare services and products. It prohibits individuals or entities from knowingly submitting false claims to Medicare or Medicaid or influencing such submissions. Violations can result in severe financial and criminal penalties for those involved in fraudulent claims.

Want to stay informed?

Check out our blog post on Legal and Ethical Considerations in Medical Billing.

The Anti-Kickback Statute (AKS)

The federal Anti-Kickback Statute (AKS) mandates it a criminal offense to intentionally offer, receive, solicit, or pay anything valuable to encourage or reward referrals for federal health care program services. “Remuneration” encompasses various forms of value, like money or benefits. This statute bars practices from offering gifts for referrals. Violating the AKS occurs if a provider purposefully offers something valuable to secure a patient referral, leading to both AKS violations and False Claims Act infringements in submitted claims for that patient.

The No Surprises Act

The No Surprises Act is a federal law that became effective Jan. 1, 2022. Surprise bills often occur when patients receive care from out-of-network providers or facilities, leading to balance billing. This Act helps patients understand healthcare costs upfront and minimizes surprise medical bills. It aims to reduce such instances, especially during emergencies or scheduled services where patients couldn’t anticipate network status. It mandates informing patients about potential out-of-network charges for scheduled care and obtaining their consent where applicable.

Medicare and Medicaid Billing Regulations

As the largest healthcare programs in the United States, Medicare and Medicaid offer valuable benefits to patients. But navigating their billing complexities is often a challenge for providers. Billing demands precise documentation and adherence to regulations for services like telehealth, screenings, and vaccinations. Following coding, eligibility, and documentation guidelines while preventing fraud ensures proper reimbursement and compliance. Staying updated on Medicare and Medicaid changes is vital, prompting providers to adapt billing practices to evolving healthcare landscapes.

Complying with Government Billing Regulations

Adhering to government healthcare billing regulations is crucial for many reasons:

- Safeguards patients against overbilling or erroneous charges

- Enhances the efficiency of the patient journey

- Curbs fraud, wastage, and misuse within the system

- Ensures fair, accurate, and timely payments to medical providers, contributing to their financial sustainability

- Upholds the integrity of the healthcare system and the reputations of medical institutions

- Shields organizations from liability associated with fraudulent billing practices

Health care billing compliance ensures that all claims, billing, and coding of health care services are accurate and meet regulatory requirements. To ensure compliance, health care organizations need to understand the reasons behind the rules, understand billing challenges, identify ethical practices, and implement compliance best practices to limit potential liability. They should develop comprehensive written policies and procedures and implement them. Providing effective training and education, fostering open lines of communication, and conducting regular risk assessments and audits are integral components of medical billing compliance efforts. Healthcare providers have the option of hiring reliable medical billing services from a company like OSI (Outsource Strategies International), which is a practical way of addressing coding and billing challenges. Typically, our medical billing team would always manually review the claims before submitting them to payers. Importantly, we make sure that the medical codes used are based on the actual documentation provided and not coded higher with a view to maximize reimbursement.

Ensure precision, adhere to regulations, and prioritize patient care with our expert medical billing services!