For a dental practice, revenue cycle management is just as important as patient care. Daily dental billing and insurance coverage collections for the services rendered is the fuel that keeps a dental practice profitable. Accurate documentation, timely claims submission and seamless communication with insurance providers are key when it comes to the financial success of your dental practice. However, navigating the complexities of dental billing and health plans can be a formidable challenge for dental professionals.

Diversifying your services that qualify for insurance coverage broadens the scope of medical billing and helps meet the evolving needs of patient care. Adopting the best medical billing strategies is necessary for securing payments from both insurance companies and patients. Dental billing services provided by an experienced billing firm ensure that dental practices have fewer accounts receivable and unresolved dental claims.

Benefit from streamlined dental billing services from Outsource Strategies International.

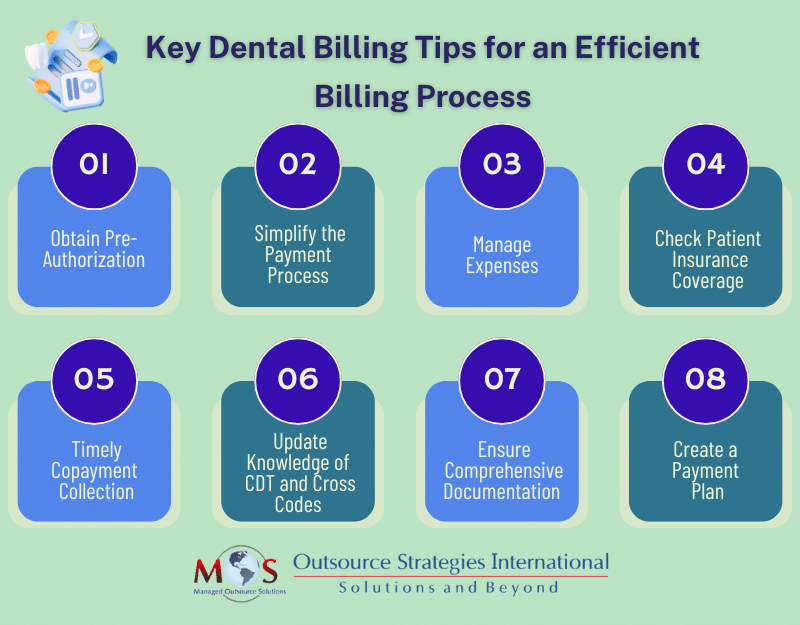

Essential Dental Billing Tips

Let’s delve into some key billing tips for dental practices:

Pre-authorization is vital

Obtaining pre-authorization is a non-negotiable practice that protects your dental clinic as you can’t be sure if a procedure will be reimbursed by your patient’s payers. Before performing any procedure, especially costly ones, it is important to submit for a pre-authorization to shield your patients and practice against any surprises that arise as unexpected deductibles or denied claims. Once you gain clarity on what exactly your patient’s co-payment will be, you can then structure a straightforward payment plan. Employing this approach is considered a best practice, especially for extensive treatments or when dealing with new CDT codes, as it helps maintain patient trust by minimizing the occurrence of unexpected billing statements.

Simplify your payment process

Modernize your dental billing process by implementing different methods of payment as your patients come from different demographics, which influences how they prefer to pay. Not all patients are comfortable with online payments, and their proficiency with online payments or phone-based payments can vary. Increase the likelihood of receiving timely payments by providing more payment options to accommodate various preferences and tech-savviness levels. The convenience of patients should be the priority here, as it helps to maximize your revenue. Collecting outstanding patient balances could be difficult, and you can mitigate this issue by providing various options such as:

- Cash

- Credit/debit card

- Auto-pay on specific dates

- Online payment portal

- 24/7/365 automated phone payments

Manage expenses

Investigate ways to alleviate the costliest aspect of dental billing, which is typically the processing of insurance claims. Regrettably, insurance billing frequently contributes to rising operational expenditures. Each unresolved claim necessitates subsequent actions, which can be challenging. Most busy teams struggle to keep pace with the insurance company’s delaying tactics, often involving extended periods on hold. Additionally, there are ongoing industry changes beyond your influence, such as federal and state regulations, modifications in CDT coding, shifts in insurance policies, updates to patient information, and the various tactics employed by insurance providers to reject, delay, or reduce payments.

Checking the patient’s insurance coverage

Many dental professionals are forced to learn this tip the hard way, usually when it negatively affects the cash flow to the practice. After obtaining the patient’s personal and insurance information, it is crucial to verify its accuracy by either contacting the insurance company directly or accessing the insurance portal. Dental eligibility verification is a crucial step in ensuring that patients’ insurance coverage aligns with their treatment plans before any procedures are performed. This verification process allows you to have a comprehensive overview of the patient’s benefits and assess the current status of their coverage. This step is essential for making informed decisions regarding their treatment and ensuring a smooth and accurate billing process.

Collect co-payment on day of service

Instruct your staff to keep track of the patient’s appointment days to request their initial payment amount before or on the day of appointment. This transparency regarding the financial responsibility of your patient will help to earn their trust and retain your patients as no one wants to deal with unexpected expenses. To aid the collection process, document and maintain accurate notes on which patient paid their full dues and which one didn’t. Doing so not only improves collection rate, but also reduces the chances of no-shows as patients who pay in advance are not likely to cancel the appointment. Additionally, it also helps you stay compliant with the medical regulations such as No Surprises Act, in the event of your patient’s coverage being out-of-network.

Keep up with the changes related to CDT Codes and medical cross codes

The world of dental billing is constantly changing, so keep up with the updated CDT codes relevant for your dental specialty. If you don’t have an experienced dental coder, then you may need to dedicate a huge chunk of your practice or personal time to keep up with the latest codes. Wrong code submission or careless coding habits could result in claim denials or rejection. In order to prevent such scenarios, you can consider outsourcing your dental coding and billing to a third-party company that specializes in dental billing processes.

When you submit dental claims, you are sometimes required to perform medical-dental cross coding. This process is when a patient needs medically necessary dental service; you bill the dental procedure to patient’s medical plan rather than their dental insurance. Dental plans are increasingly requiring the submission of dental procedures that are considered medical in nature to the patient’s health plan rather than their dental plan. Failure to comply with this standard may result in claim denials or rejection.

Document dental procedures

Accurate documentation is critical and you may develop tools and systems required for the dental documentation process including insurance verification and billing accounts, and patient record management software to facilitate the process. During the patient’s appointment, as they undergo treatment, a member of the care team is responsible for documenting essential information and assigning the procedure codes. Important documents that you can include in the process are:

- X-rays

- Past medical and dental records

- Patient personal information such as name, age and contact number

- Diagnostic notes

- Photographs and radiographs

- Progress and treatment notes

- Periodontal charting

- Follow up and periodic visits record

- Consent/ refusal forms

- Referral or consultation letters

Typically, an administrative team member oversees the process, ensuring that it is thoroughly documented, reviewed, and electronically signed by the provider within the dental software. Implementing a daily sign-off on the day sheet is considered a best practice to consistently confirm that the treatment provided in the dental chair is accurately reflected in the software and on the patient’s ledger for billing purposes.

Create a payment plan

Financial circumstances vary from one patient to another and financial constraints are a reality for most people, so it makes sense for you to provide multiple budget-friendly payment plans that are covered over a period of time. Create structured, flexible bill payment options that allow patients to pay on a monthly basis or a specifically scheduled recurring auto pay to have the benefit of receiving the amount in full. This consumer-centric strategy means your practice doesn’t lose out on missed revenue, as your patients don’t have to worry about paying a huge amount straightaway. Discussing and finalizing convenient payment plans with your patients will automatically hasten consistent cash flow to your dental clinic.

Dental Services – What Medical Plans Pay

Dental insurance is available to be purchased for patients either as part of medical policy or separate dental health plans through a dental insurer. Here are the types of dental care that medical plans pay for:

- Preventive dental care – The most commonly covered dental services are preventive dental care which includes care programs such as dental exam, cleanings, fluoride rinses, x-rays and oral cancer screenings. Dental plans also offer coverage for a minimum of two visits per year at 100% of the costs.

- Restorative care – These include only the basic care treatments for damages that happened, such as cavities, gingivitis or other oral infections. Dental plans may offer coverage for treatments including filling, simple tooth extractions, crowns or root canals.

- Major dental care – This type of dental work needs more complex and costly restorative care that requires invasive procedures such as oral surgery or use of anesthesia. Dental plans usually offer coverage only for half of the cost for the procedures performed.

Certain dental procedures performed for cosmetic reasons such as teeth whitening, braces or retainers are considered aesthetic in nature since it isn’t a medical necessity and therefore, typically not included in dental healthcare plans.

An article in Dental Economics points out that some plans may provide coverage for dental implants used for reconstruction following trauma or cancer surgery. Oral surgeons also report exams, consultations, diagnostic, physical therapy, equilibration, and splint therapy to medical insurance using CPT codes.

Insurance Considerations

Dental health plans work differently from medical health plans, and may come with strict limitations and restrictions. These include annual caps, pre-existing conditions and dental care visit frequency limit. The reason for this is that most individuals do use their dental insurance policy allowed per year and to keep dentistry care from going up to remain profitable, dentals insurers place severe limits on the benefits offered for dental care. Depending on the plan, insurers will pay an annual maximum amount for dental services rendered with visitation limits, usually twice per year for preventive care. It must also be noted that there might be a waiting period before the plan will begin covering certain types of care. So, before any dental procedure is given, it is important to check the patient’s dental insurance details to see if benefits can be availed.

Dental insurance verification is important to verify benefits and coverage prior to initiating treatment. In the present day, an increasing number of dentists are recognizing the cost-effective benefits of entrusting their dental billing to external service providers. These specialized companies possess an intricate grasp of the complexities within insurance processes, guaranteeing swift and efficient claims submission to optimize practice reimbursement.

Hire our dental billing experts to streamline operational efficiency and boost the net revenue of your dental practice.

Outsourcing companies that provide dental billing services have eligibility verification built into the process. Benefits verification requires diagnosis and procedure codes, which are determined after the comprehensive exam and radiographs are done. Collaborating with a dental billing company is a financially prudent choice compared to establishing an internal team, as it eliminates expenses related to sick leave, insurance, vacations, time off, and employment taxes. Furthermore, outsourcing releases your staff from administrative burdens, enabling them to dedicate their attention to providing top-notch patient care.

![Dental Insurance Verification: Best Practices for Success [Updated for 2025]](https://www.outsourcestrategies.com/wp-content/uploads/2024/11/dental-insurance-verification-best-practices-for-success-400x250.jpg)