With so many technological innovations and other advancements, the healthcare field has been revolutionized. The focus now is on patient-centric approaches to deliver exceptional care experiences. One key aspect of this is ensuring that insurance eligibility verification processes are not only efficient but also patient-friendly. By following useful guidelines and best practices for a patient-centric approach in insurance checks, healthcare providers can enhance patient satisfaction and streamline administrative workflows. Meanwhile, the most hassle-free way to ensure accurate verification of patient benefits is to enlist the services of a reliable medical billing company.

We ensure optimized health insurance verification process for all medical specialties.

Benefit from accurate and hassle-free patient eligibility checks!

CALL: (800) 670-280

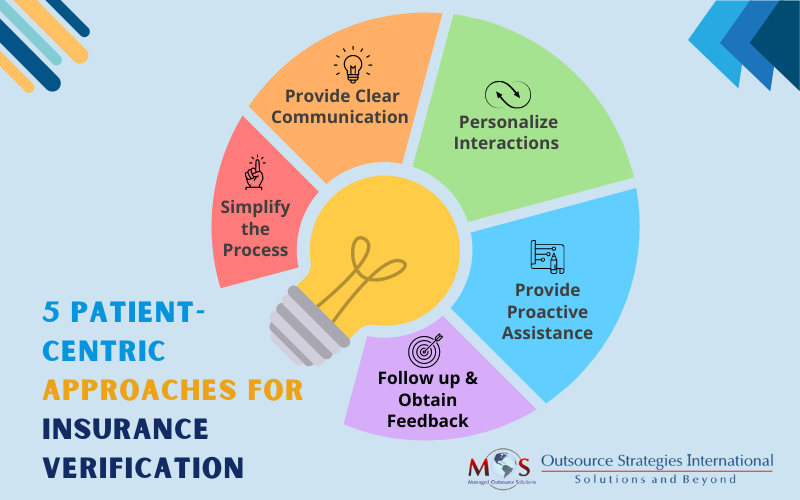

Guidelines for Implementing Patient-friendly Insurance Eligibility Checks

Here is a look at some best practices for creating a patient-centric approach:

- Simplify the process: Streamline the eligibility verification process by utilizing user-friendly platforms or software that simplify data entry and minimize patient burden. Providers can offer secure online portals or mobile apps so that patients can enter their insurance information at their convenience. This is advantageous because it reduces the need for repetitive data collection during in-person visits. You can introduce a patient portal where your patients can upload photos of their insurance cards and complete the necessary forms digitally. This will reduce wait times and lead to enhanced patient satisfaction.

- Communicate clearly to your patients: Give your patients all details, including what information is needed and how it will be used. Offer explanations in simple language, avoiding jargon or technical terms that may confuse patients. You can create informational brochures or online resources that explain the process step-by-step, including common terminology and frequently asked questions. This enables patients to understand their role in the process.

- Personalize interactions with your patients: This can be done by addressing your patients by name and showing them empathy and understanding. Train your staff to actively listen to patients’ concerns and provide assistance customized to their individual needs.

- Provide proactive assistance: Anticipate common challenges patients may face and give them hands-on assistance. Provide resources and support to help patients navigate insurance-related issues, such as understanding coverage details or resolving discrepancies.You can establish a dedicated patient advocacy team to assist patients with insurance verification and billing questions. This team can reach out to patients, providing guidance and support throughout the process to lighten stress and confusion.

- Make sure to follow up and obtain feedback: Follow up with patients after the insurance verification process to ensure their needs were met and request feedback for improvement. You can use patient feedback to improve and optimize the process, continually striving for improved patient satisfaction. For example, consider sending post-appointment surveys to patients, asking about their experiences. Based on the feedback received, you can make necessary adjustments to the process and address any pain points identified by patients.

- Utilize technology: Consider the use of automation and artificial intelligence (AI). Offer online chatbots or virtual assistants to provide instant support and guidance to patients regarding insurance-related queries.

- Customize communication channels: Provide multiple channels for patients to communicate their insurance information and preferences, such as online forms, email, phone, or in-person consultations. Allow patients to choose their preferred method of communication for receiving updates and notifications about their insurance verification status.

- Empower patients with education: Offer educational resources, such as videos or webinars, to help patients understand the importance of insurance verification and how it impacts their healthcare experience. Provide access to resources that explain common insurance terms and concepts, so that patients can make informed decisions about their coverage.

- Collaborate with insurance providers: Foster open communication and collaboration with insurance companies to expedite verification processes and resolve coverage issues efficiently. Advocate for patient-centric policies within insurance networks, such as timely approvals and transparent communication regarding coverage details.

- Ensure data security and privacy: Implement robust data security measures to safeguard patients’ sensitive information. Clearly communicate your organization’s commitment to protecting patient privacy and complying with relevant regulations, such as HIPAA (Health Insurance Portability and Accountability Act).

- Continuous improvement: Regularly evaluate and assess the effectiveness of patient-centric approaches through feedback mechanisms and performance metrics. Identify areas for improvement and implement strategies to address patient concerns or streamline processes further.

- Promote financial transparency: Provide upfront estimates of out-of-pocket costs and potential insurance coverage limitations to patients before services are rendered. Offer financial counseling services to assist patients in understanding their financial responsibilities and exploring available payment options or assistance programs.

- Empathetic problem resolution: Train staff to handle insurance-related inquiries and disputes with empathy and professionalism, focusing on finding solutions that prioritize patient well-being. Establish clear escalation procedures for resolving complex issues or patient complaints in a timely and empathetic manner

Looking to deepen your understanding?

Discover insights on patient communication and insurance verification.

By implementing these best practices for creating a patient-centric approach in insurance checks, you can create an approach to insurance verification that prioritizes the needs and experiences of patients. This not only helps improve patient satisfaction but also contributes to more efficient and effective administrative processes within your organization.