Running a financially healthy dental practice is no small feat. While the main priority is your patients’ oral health, you also need to stay focused on your business’s bottom line. Outsourced dental billing services can improve your facility’s financial health by ensuring efficient revenue cycle management and optimizing your cash flow. This involves properly documenting and coding procedures, submitting accurate insurance claims, and importantly, managing accounts receivable (A/R) effectively.

In a recent news report, the American Medical Association, noted that physicians and practice managers still face a steady stream of financial challenges and need to keep track of and manage the revenue cycle process-the way you get paid. The A/R metric is one of the most important when it comes to gaining an understanding of your practice’s financial health.

The A/R balance represents the outstanding amount that patients or insurance companies owe your practice for services rendered. Tracking and collecting A/R is crucial because no dental practice can continue delivering care without receiving payments. However, delayed payments, claim denials, and administrative errors can make A/R collection a major challenge. Here, we aim to provide you with a comprehensive guide to A/R collection in dental practices.

Struggling with unpaid insurance claims?

Take your A/R management to the next level!

Understanding A/R Days in Dental Practices

It’s crucial to understand the average number of days your dental practice waits between sending out bills or claims and receiving payments from patients and insurance. A shorter duration signifies quicker payment, while a longer duration may suggest delays.

A/R within 30 days is the widely accepted rule. When your dental practice is carrying a large A/R balance, especially when it includes overdue amounts exceeding 90 days, the effectiveness of your collection efforts diminishes. Monitoring the percentage of A/R that has aged beyond 90 and 120 days is necessary as it serves as a key metric for assessing your practice’s ability to receive timely payments. If your practice offers dental services on credit terms, it’s vital to consistently oversee and manage your accounts receivable.

An average of over 60 days in AR could be due to various reasons:

- A payer delaying payments: A payer may delay dental claims on the basis of inaccurate patient information on the claim or reject a claim on the grounds that the treatment was not medically necessary based on the diagnosis.

- A high rate of claim denials around specific procedures: For instance, periodontal scaling and root planing (SRP) tend to have a higher frequency for denial than other procedures.

- Dental billing errors: dental coding errors, insufficient documentation, not submitting claims on time, etc.

Unpaid balances are one of the biggest challenges in dental billing.

Let’s take a look at best practices for AR collection in dental practices.

Basic Guidelines for Improving A/R Collection

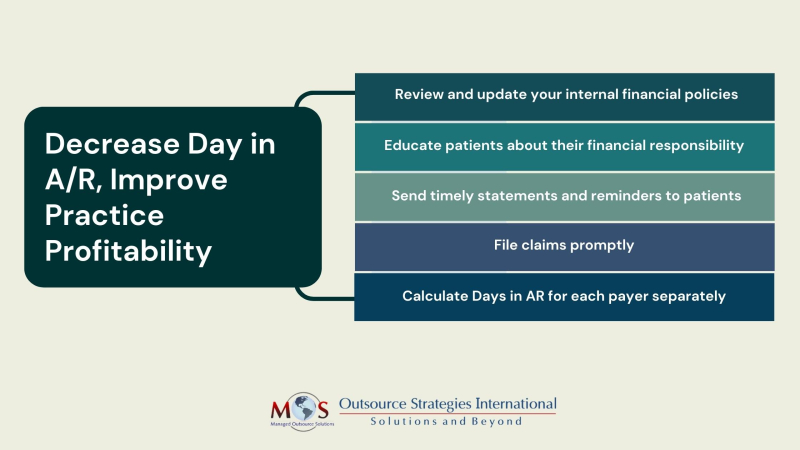

Generally speaking, the best way to manage accounts receivable is to establish clear financial policies, maintain accurate and up-to-date records, promptly follow up on unpaid invoices, and ensure open communication with clients to address any outstanding balances. Here are five basic steps for improving A/R collection in dental practices:

- Review and update your internal financial policies and protocols

If it’s taking too long or getting harder to collect fees, the American Dental Association (ADA) suggests reviewing your internal policies and written payment information for patients. Your financial policy should clearly outline the steps your staff should follow when collecting overdue fees for provided treatments, including documenting any promises from patients to pay their balances.

Update patient documents to ensure they understand their responsibility to pay for services before or at the time of treatment. If patients have dental benefit coverage and assign benefits to you, collect the patient’s share at the time of service. If a balance remains after you receive benefit payments, promptly send the patient a statement showing the amount due. For frequent balances, consider having patients authorize credit card charges to cover remaining costs after third-party payments.

Having appropriate financial policies in place and ensuring they are effectively communicated is a best practice for avoiding accounts receivables (AR) issues.

- Educate patients

Many patients don’t have a clear understanding of how dental practices handle payments from insurance providers and may be unsure of their financial responsibilities when receiving services. Offering a brochure or reference sheet to all patients, explaining their part and obligations in the payment process, can help alleviate confusion. Also, having a knowledgeable staff member who can address patients’ inquiries about the claims and payment process is crucial.

Additionally, you can improve customer communication with payment portals. This will provide patients with instant access to self-service 24/7 and also information like payment balances and due dates on-demand.

- Mail timely statements and reminders to patients

Mail weekly statements to every patient with unpaid balances, including patients with a remaining balance after dental benefits payment. Include a due date on each statement, and use gentle reminders on overdue statements to keep patients informed about their account status. This is essential for monitoring your accounts receivable. Follow up on the initial statement and reminder phone call with a reminder notice.

Invoices also serve as valuable records in case of potential errors or disputes, such as overcharges or undercharges. Additionally, consider making follow-up calls to ensure your clients have received their invoices.

Accounts overdue by more than 30 days need special attention. In such cases, the ADA recommends that it’s best to have your office manager or other responsible person with communications training contact the patient by phone for payment. Be proactive and inform the patient about your payment plan procedures, including a follow-up call five days after the due date.

The final step is to move to a negotiation process and a final letter explaining steps you will take in order to receive payment. Make sure all communication is a professional and nonjudgmental, and a dated, factual record of the collection process.

- Ensure timely filing

delaying claim submissions can result in a growing accounts receivable balance over time, as many insurance carriers have strict deadlines for claim submission, typically within days or weeks after treatment. Claims submitted after this window will likely face routine denials.

Electronic claim submissions expedite the payment process. Implementing technology solutions designed for dental practices, such as specialized financial management software, digital practice management systems, and electronic health records (EHRs), can significantly boost productivity, accuracy, and financial oversight. Additionally, scheduling platforms can streamline administrative tasks, minimize errors, and save valuable time.

- Determine Days in AR for each payer separately

It’s crucial to calculate the days in A/R individually for each payer. You should have a clear understanding of the average days in A/R for all your payers collectively, as well as a breakdown for each specific payer. This will allow you to identify payers with longer-than-average AR periods, helping you identify potential billing process inefficiencies for those specific payers and take measures to expedite the payment process.

If your dental bills are not getting paid on time, think about hiring professionals to handle your billing. Dental billing services can make sure your billing is done right, which reduces the chances of your claims being rejected. Experts can enhance billing efficiency, follow up on unpaid claims, and help you implement effective collection strategies, preventing revenue losses and increasing your profits.

Learn how we can optimize your revenue cycle and streamline you financial operations!