The integration of machine learning (ML) into various industries has revolutionized the way organizations analyze data and make informed decisions. Predictive insurance verification analysis is one such area that has seen significant advancements. Predictive analysis in insurance verification with machine learning (ML) can help streamline and automate various aspects of insurance eligibility, including risk assessment, decision-making, and fraud detection.

From streamlined insurance verification and billing solutions to cutting-edge telehealth integration, we’ve got you covered.

Machine Learning for Predictive Analysis in Insurance Verification

Insurance verification plays a crucial role in assessing risk, determining policy eligibility, and combating fraud. The conventional process relies heavily on manual review and analysis of documents, which can be time-consuming and error-prone. By incorporating machine learning techniques, insurers can leverage predictive analysis to automate and streamline the verification process.

This is how it works:

Machine learning algorithms, like classification, regression, and anomaly detection, can be used to gain insights from large data sets. These algorithms learn from historical patterns to predict and detect potential risks or fraud. Insurers can use these algorithms to make informed decisions and take proactive measures to mitigate risks. For instance, ML-based predictive analysis can estimate the risk of offering health insurance to individuals, enabling precise pricing based on eligibility and past behavior patterns.

How Machine Learning Techniques can enhance Patient Eligibility Verification

Here’s an overview how machine learning can support Insurance verification predictive analysis:

Risk assessment

Machine learning models can analyze historical data related to claims, policyholders, and external factors to predict potential risks accurately. By identifying patterns and correlations in vast datasets, ML contributes to a more precise understanding of risk profiles, helping insurance companies proactively manage and mitigate potential issues.

Pricing optimization

Predictive analysis using machine learning enables insurance companies to refine their pricing models. By evaluating various factors, such as demographics, past claims, and market trends, these models can predict optimal pricing structures. This contributes to fairer premiums and improved competitiveness in the market.

Improves underwriting efficiency

Machine learning algorithms can streamline the underwriting process by automating the assessment of policy applications. These algorithms analyze diverse data sources, ensuring a comprehensive evaluation of risk factors and enabling quicker and more accurate underwriting decisions.

Claims processing

Predictive analysis can significantly impact claims processing. Machine learning models can assess historical claims data to identify patterns indicative of fraudulent activities or irregularities. This proactive approach helps insurers detect and address potential issues before they escalate, improving the efficiency of claims management.

Customer behavior analysis

Understanding customer behavior is crucial for insurance companies. Machine learning models can analyze customer interactions, preferences, and historical data to predict future behavior. This information assists insurers in tailoring their services, improving customer satisfaction, and enhancing retention rates.

Fraud detection and risk assessment

One of the significant advantages of utilizing machine learning is its ability to detect fraud and assess risk more effectively. By continuously learning from historical data and identifying anomalous patterns, these models can flag potentially fraudulent activities, enabling insurers to investigate and prevent fraudulent claims more effectively, potentially reducing financial losses.

Operational efficiency

Machine learning can also streamline the insurance verification process by automating routine tasks, reducing manual effort and leading to improved operational efficiency. Predictive models can quickly analyze and verify customer information, policy details, and supporting documents, enabling insurers to make faster decisions and focus on more complex and strategic aspects of their operations. This automation also enhances the overall customer experience by reducing processing times and minimizing delays.

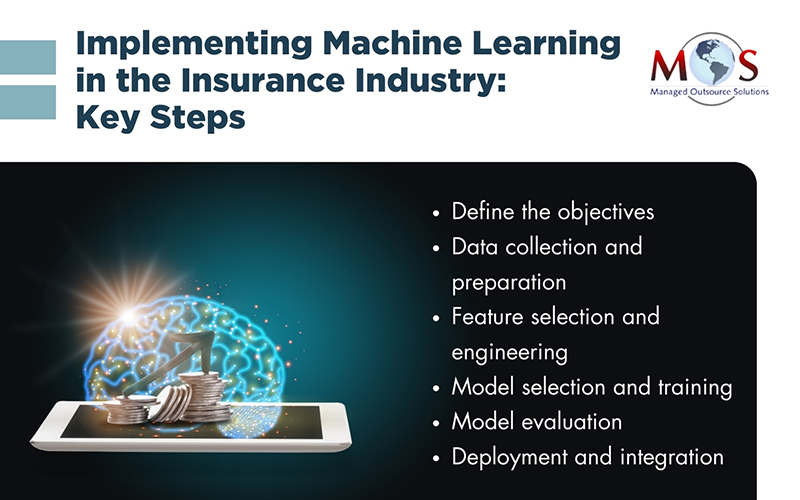

Guide for Integrating Machine Learning into Insurance Eligibility Processes

- Define the objectives: First, clearly define the objectives of integrating machine learning into your processes. This could include improving accuracy and efficiency in assessing risk, reducing manual labor, detecting fraud, or enhancing customer experience.

- Data collection and preparation: Collect relevant data for training the machine learning models. This may include historical insurance data, customer information, claims data, and any other relevant data sources. Ensure the data is accurate, comprehensive, and representative of the target population. Clean and preprocess the data, addressing missing values, outliers, and inconsistencies.

- Feature selection and engineering: Use domain expertise and statistical analysis to identify the relevant variables that can contribute to the prediction of insurance eligibility. Additionally, develop new features from the existing ones to capture complex relationships and improve model performance.

- Model selection and training: Choose appropriate machine learning algorithms based on the nature of the problem and available data. Train the selected models using the prepared data, using techniques such as cross-validation to evaluate and fine-tune model performance.

- Model evaluation: Assess the performance of the trained models based on relevant evaluation metrics such as accuracy, precision, recall, and F1 score, and validate them on a separate test dataset to ensure their generalization ability.

- Deployment and integration: Integrate the trained machine learning models into the insurance eligibility processes. This may involve developing APIs or incorporating the models into existing software systems. Collaborate with IT teams to ensure smooth deployment and integration, addressing issues related to data flow, security, and scalability.

To uphold accuracy amid evolving insurance landscapes, the deployed models need to be consistently monitored and periodically retrained. Ensuring compliance with regulations and ethical guidelines is also crucial when integrating machine learning into eligibility processes. Collecting user and stakeholder feedback can identify areas for improvement. Ultimately, successful implementation demands thorough analysis, expertise, and collaborative efforts across organizational teams.

Want to stay informed about the latest trends in insurance verification?

Read this post: Emerging Trends and Innovations in Insurance Verification.

Human Expertise is Still Relevant

While machine learning automates insurance verification, human support remains crucial for maximizing efficiency with advanced predictive analysis in insurance checks. Healthcare providers rely on human insurance verification specialists to inform patients of their financial responsibility before appointments. Humans have cognitive abilities necessary for understanding complex scenarios, ethical implications, and making decisions in ambiguity. They are also essential in customer service, communication, and handling unpredictable situations, where their intuition and experience are invaluable. The most efficient solutions often emerge from a blend of automation and human expertise.

Maximize practice efficiency with our comprehensive insurance verification services.