Verification of patient benefits plays a key role in ensuring financial stability and efficient operations in healthcare organizations. The process involves confirming the coverage details and eligibility of patients’ insurance plans before providing medical services. This step is essential to prevent financial challenges for both healthcare providers and patients. By verifying insurance information upfront, providers can accurately estimate patients’ out-of-pocket expenses, reducing the risk of billing errors and claim denials. This process also aids in streamlining the reimbursement process, as accurate and up-to-date insurance information facilitates smooth claims processing.

Insurance verification also helps healthcare providers maintain compliance with regulatory requirements and contractual obligations with insurance companies. Error-free insurance verification services enhance the financial health of healthcare organizations, minimizes administrative burdens, and ultimately contributes to the delivery of quality patient care. The importance of insurance verification cannot be overstated.

Stop claim denials in their tracks. Benefit from effective insurance verification services!

Here’s a clear explanation of What the Patient Eligibility Verification Process Involves:

Benefits of Insurance Eligibility Verification in Healthcare

Insurance eligibility verification in healthcare offers several benefits such as:

- Accurate financial planning

- Minimized claim denials

- Clean claim submission

- Time and resource savings

- Optimized staff productivity

- Prevention of fraud and abuse

- Compliance with regulations

- Increased cash flow

- Enhanced patient satisfaction

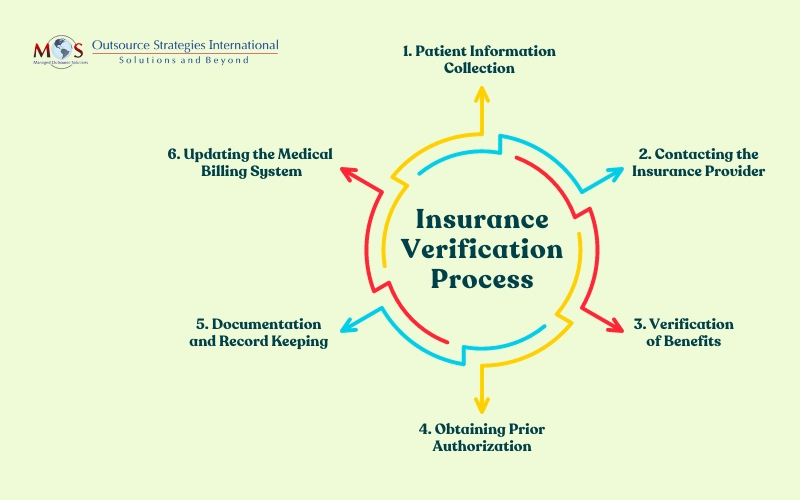

Here is an overview of the insurance verification process:

Steps for Efficient Healthcare Insurance Verification

The healthcare insurance verification process is crucial for healthcare providers to ensure accurate billing and reimbursement. Here is a step-by-step guide to effective insurance verification:

- Gather patient information: Once the patient appointment is scheduled, collect all essential details from patients, including their full name, date of birth, contact information, social security number, insurance details and insurance card.

- Verify patient eligibility: Use the gathered information to check the patient’s eligibility with the insurance provider. This involves confirming the coverage start date, policy status, and any pre-existing conditions or limitations.

- Confirm insurance coverage: Validate the specific healthcare services covered by the insurance plan to avoid potential claim denials. Check for limitations, exclusions, and required referrals or authorizations.

- Determine co-payments and deductibles: Identify the patient’s financial responsibilities, such as co-payments and deductibles. Understanding these aspects helps in providing accurate cost estimates to patients before services are rendered.

- Check in-network providers: Verify if the healthcare provider is in-network with the patient’s insurance plan. In-network services typically result in lower costs for patients, and this information is vital for both the provider and the patient.

- Obtain pre-authorizations if required: Identify services that require pre-authorization from the insurance company. Obtaining necessary approvals beforehand prevents claim denials and ensures the reimbursement process runs smoothly.

- Coordinate benefits for multiple insurances: If a patient has more than one insurance plan, coordinate benefits to determine the primary and secondary insurance coverage. Understanding the order of coverage helps in submitting claims accurately.

- Communicate with patients: Clearly communicate the verified insurance details, including coverage information, co-payments, and deductible responsibilities, to the patients. This transparency helps manage patient expectations and fosters a positive patient-provider relationship.

- Update the billing system: Integrate verified insurance information into the billing system, to maintain a real-time and comprehensive record of patients’ coverage details, co-payments, and deductibles. This seamless integration minimizes the risk of billing errors, claim denials, and delays in reimbursement.

By following this systematic verification process, providers can enhance their billing accuracy, minimize claim denials, and ultimately improve the financial health of their practice while ensuring a positive patient experience.

Gain peace of mind with OSI’s services offering a comprehensive overview of medical insurance eligibility checks. From coverage details to patient financial responsibilities, we ensure every aspect is thoroughly examined for accuracy and precision. Our verification specialists work 3 days ahead to ensure our clients have the time to provide their patients’ benefits before the visit. The patient then knows exactly what their out of pocket costs will be so there are no surprises.

Boost revenue and streamline billing with our patient eligibility verification!