Efficient insurance eligibility verification is a key component of the revenue cycle management process, ensuring that healthcare providers accurately confirm patients’ insurance coverage, eligibility, and benefits before delivering medical services. Advanced software can now automate insurance verification, minimizing the likelihood of costly mistakes and enhancing overall operational efficiency.

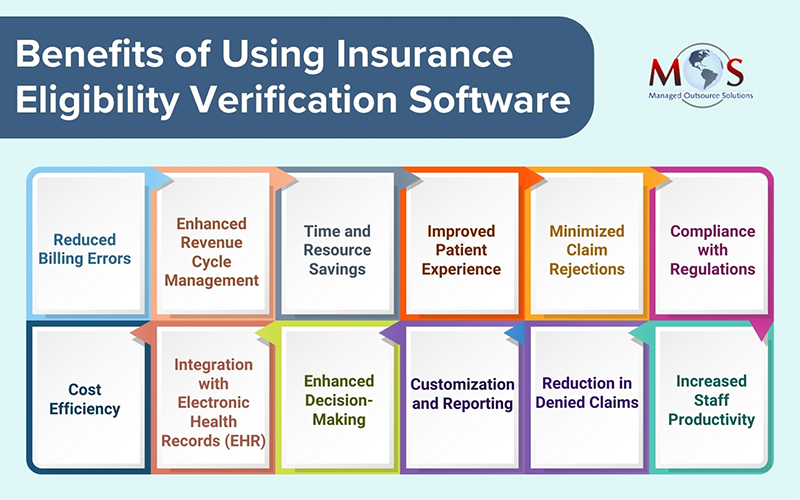

By staying up-to-date with patients’ insurance information, medical practices can optimize reimbursement processes, mitigate financial risks, and foster a smoother and more reliable revenue cycle, ultimately contributing to the financial health and sustainability of the healthcare organization. Insurance verification software is an automated tool that accesses patient insurance information on payer and other databases to confirm eligibility, coverage details, and benefits. This software helps healthcare providers avoid denials due to inaccurate or incomplete insurance information and reduces the administrative burden involved in manually verifying eligibility. Major benefits of using technology integrated insurance verification include reducing the risk of claim denials and billing errors, streamlining administrative tasks, and allowing healthcare professionals to focus more on patient care.

Many patient eligibility verification tools seamlessly integrate with EHR systems, ensuring a cohesive and connected healthcare information infrastructure.

Our insurance verification services bring efficiency and accuracy to your revenue cycle.

Best Tools for Insurance Eligibility Checks

Practice management software

- Epic Systems: Epic is a widely used electronic health record (EHR) and practice management software that includes features for insurance eligibility verification.

- Cerner: Another popular EHR and health information technologies provider, Cerner offers solutions that integrate insurance eligibility checks into the workflow.

- Athenahealth: Athenahealth provides cloud-based services for healthcare organizations, including features for verifying insurance eligibility.

Clearinghouses

- Change Healthcare: Formerly known as Emdeon, Change Healthcare is a healthcare technology company that offers a variety of solutions, including insurance eligibility verification services.

- Availity: Availity is a healthcare information network that offers a range of services, including real-time eligibility and benefits verification.

Specialized eligibility verification tools:

- Quadax Insurance Eligibility: Some tools are specifically designed for insurance eligibility verification, such as Eligibility and Benefits Verification Software by Quadax.

- Zirmed (Now part of Waystar): Zirmed offers revenue cycle management solutions, including eligibility verification services.

EDI (Electronic Data Interchange) solutions:

- RelayHealth (Now part of Change Healthcare): RelayHealth offers EDI solutions that include eligibility verification services.

Key Features

Effective patient eligibility verification software plays a crucial role in streamlining healthcare processes and ensuring accurate billing. The key features of such software should address the complexities of insurance eligibility verification and enhance the overall revenue cycle management. Some of the key features to consider include the following:

- Real-time eligibility checking: Provides instant verification of patient insurance eligibility to ensure that the information is up-to-date at the point of care.

- Coverage details: Retrieves comprehensive coverage details, including policy start and end dates, co-pays, deductibles, and maximum benefits.

- Batch verification: Supports batch processing to verify the eligibility of multiple patients simultaneously, improving efficiency for larger healthcare practices.

- Integration with EHR/PM systems: Seamless integration with Electronic Health Record (EHR) and Practice Management (PM) systems to automate the eligibility verification process within existing workflows.

- Customizable workflows: Allows customization of workflows to align with the specific needs and processes of healthcare providers.

- Automated alerts and notifications: Sends alerts and notifications for any discrepancies or changes in patient insurance information, helping to prevent billing errors.

- History and audit trail: Maintains a detailed history and audit trail of eligibility verification transactions for compliance purposes and dispute resolution.

- Insurance payer connectivity: Connects to a broad range of insurance payers, supporting various healthcare plans to ensure comprehensive coverage verification.

- Patient information accuracy: Cross-references patient demographics to ensure accuracy in the provided information, reducing the risk of billing errors.

- HIPAA compliance: Adheres to HIPAA regulations and other relevant data security standards to protect patient information during the verification process.

- User access controls: Implements role-based access controls to restrict access to patient eligibility information only to authorized personnel.

- Reporting and analytics: Provides reporting tools and analytics to track key performance indicators related to eligibility verification, helping healthcare organizations identify trends and areas for improvement.

While choosing the right insurance verification software, healthcare practices should consider their specific needs, the scale of operations, and the compatibility with existing systems to ensure a smooth and efficient integration into their workflow.