It goes without saying – the financial health of your medical practice is essential. Rising costs, evolving healthcare models, and increased competition have all made this more difficult than years past. Billing is a key factor of healthcare accounting, and well optimized processes are crucial to prevent claim denials. Medical billing services transform care into accurate claims, ensuring that your practice is properly reimbursed.

What is the Difference between Healthcare Accounting and Medical Billing?

Healthcare accounting and medical billing are both key components of revenue cycle management (RCM). According to Becker CPA, healthcare accounting covers “the collection, analysis and reporting of financial information for healthcare organizations of all kinds.” Healthcare accountants process and record all of your practice’s financial transactions – balance sheets, cash flow statements, taxes, billing, payroll, and more.

Billing specialists prepare and submit claims to payers and bill patients for their financial responsibility. The process involves accurately representing services provided using appropriate medical codes and submitting claims for these services to insurance companies so that you receive proper reimbursement.

Don’t let billing challenges hold you back.

Learn how our medical billing services can optimize your revenue cycle.

What Medical Billing Involves

Medical billers and coders must collaborate throughout the process to ensure that accurate claims are submitted to payers for the treatment, care, and services your practice provides.

The front office’s responsibilities include capturing and managing patient information, insurance eligibility verification, and collecting payments from patients.

The back-end of the revenue cycle covers revenue collection and management after the patient visit. Medical coders analyze the patient’s medical records and assign proper codes to represent each service, diagnosis, and treatment provided. Based on this information, the billing team creates and submits insurance claims. Effective medical billers must be familiar with all aspects of the insurance claims process, submit claims in the correct format, manage claims denials or requests for additional information, and manage accounts receivable.

Premier, a group purchasing organization, recently stated in a blog post on www.fiercehealthcare.com that just over half of denied claims are eventually paid out. This implies that about $10.6 billion is “wasted arguing over claims that should have been paid at the time of submission.” Medical billing companies provide certified professional coders and billers to prevent these denials and ensure accurate claim submission for timely and maximum reimbursement.

Understanding the Role of Medical Billing in the Accounting Process

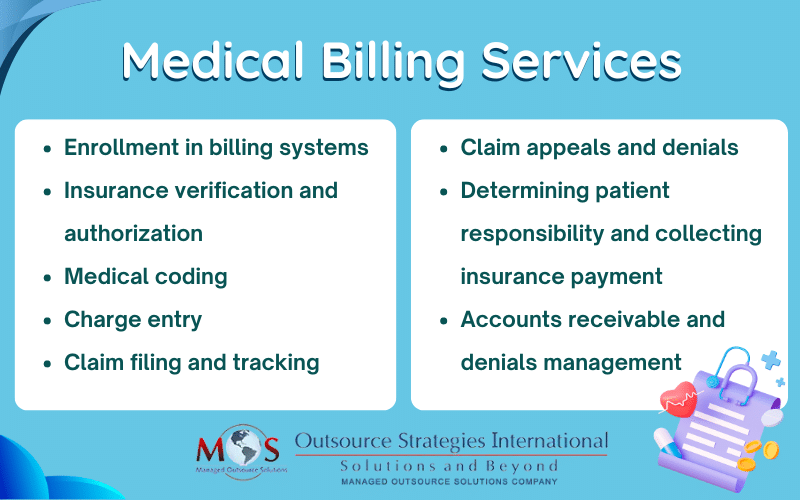

The full medical billing cycle includes the following functions, all of which contribute to the healthcare accounting process:

The main function of the healthcare accountant is to monitor and measure the revenues and expenses of the medical facility.

Here’s how medical billing supports them:

Revenue Generation

Medical billing is responsible for generating the revenue needed to run your practice. By ensuring accurate and timely claim submission, billers ensure that healthcare providers receive proper payment for the services they deliver.

Coding and Documentation

Billers ensure services are properly documented and invoiced. They take the medical codes and translate them into tangible financial transactions. Billers also perform charge validation and create a superbill, which is an itemized and detailed statement of services that is submitted to a payer for reimbursement. Proper coding and billing also greatly reduces the risk of financial penalties and audits.

Creation of Financial Records

Detailed records of patient encounters, services performed, and associated charges are all created throughout the billing process. These records are the foundation for accurate financial reporting – including balance sheets, income statements, and cash flow statements.

Claims Management

Medical billers prepare and submit claims to insurance companies. Efficient billing processes streamline claim submissions, and billers help healthcare organizations maximize reimbursement and minimize claim rejections or denials.

Accounts Receivable Management

The billing process helps track outstanding payments and manages accounts receivable (AR). It involves monitoring and following up on unpaid or partially paid claims, resolving denials or rejections, and following up on collections when necessary. Effective AR management helps identify any billing or reimbursement issues that need to be addressed and improves cash flow.

Financial Analysis

Billing helps enable healthcare providers to analyze their practice’s overall financial performance. An effective billing team will help your practice assess revenue trends, identify areas of profitability or loss, evaluate the financial impact of specific services or procedures, and help make informed financial decisions.

Cost Management

Medical billing data can be utilized to calculate the overall cost of providing specific healthcare services. By understanding the costs associated with different procedures, you can evaluate pricing strategies, negotiate reimbursement rates with insurers, and identify opportunities for cost reduction or process improvement.

Make a Smart Move – Outsource Medical Billing

In order to consistently file clean claims and avoid excessive denials, practices need to meticulously manage every step of the medical billing process, which can be complex, time consuming, and overwhelming. Following up on claims can be a major hassle, sometimes requiring numerous calls to insurance companies. Getting expert support by outsourcing your medical billing can save your practice countless hours of manual work,all while boosting your bottom line and help patients receive the coverage they deserve.

Maximize the full potential of your medical practice with efficient billing and coding!

Contact us Today for a free consultation.