Medicare audits are designed to help detect fraud, waste, and abuse while ensuring proper reimbursement. By conducting these reviews, Medicare aims to ensure that healthcare providers are comply with its billing regulations, documentation requirements, and medical necessity guidelines. In 2025, technological advancements and an intensified focus on transparency and compliance have transformed Medicare and Medicaid audits, reshaping how providers approach healthcare receivables management.

Amid stricter documentation requirements and the growing prevalence of AI-driven audits, staying informed and taking a proactive approach will be critical to maintaining Medicare compliance and avoiding potential penalties.

Ensure your practice keeps pace with evolving regulations.

Explore our comprehensive healthcare revenue cycle management services

Key Trends Shaping the Medicare Auditing Landscape in 2025

Increased Use of AI and Data Analytics

One of the most significant developments in Medicare auditing is the growing use of AI and data analytics to identify improper billing practices. In 2025, Medicare auditors will increasingly rely on AI tools to analyze large volumes of claims data quickly and efficiently. These tools can flag unusual patterns or anomalies, such as excessive billing for certain procedures or services that do not align with established clinical guidelines. InsightAce Analytics predicted that AI in the healthcare audit market is expected to grow at a CAGR of 9.8% during the forecast period 2023-2031.

Stricter Compliance Requirements for Telehealth Services

Telehealth services became a game changer during the COVID-19 and their expansion continued even after the pandemic. However, the widespread of adoption of telehealth has increased scrutiny by Medicare audits. To appropriate use of telemedicine, the audits will focus on ensuring that telehealth consultations are properly documented and conducted in compliance with Medicare guidelines.

Greater Focus on Billing for High-Cost Services

In 2025, Medicare audits are expected to pay more attention to billing for high-cost services, including surgeries, specialty treatments, and long-term care services. As reimbursements for these complex services are significantly higher, they are especially vulnerable to billing errors or fraud. Medicare auditing guidelines for high-cost medical procedures will be crucial for providers to understand in order to ensure compliance and avoid potential penalties.

Increased Scrutiny of Managed Care and Medicare Advantage Plans

Medicare Advantage (MA) plans, offered by private insurers as an alternative to traditional Medicare, will face heightened audits in 2025. The Centers for Medicare & Medicaid Services (CMS) is intensifying oversight, particularly regarding the precision of risk adjustment coding and the proper documentation of diagnoses that influence reimbursement rates.

Listen to our podcast on Medicare Auditing in 2025

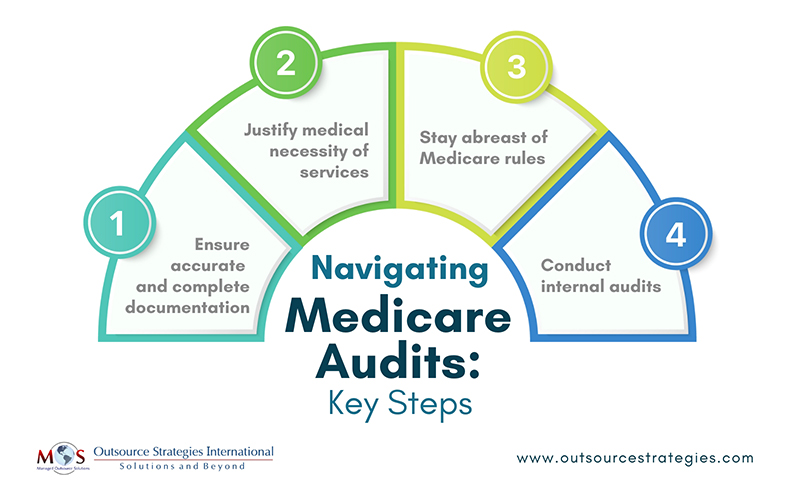

Steps to Successfully Navigate Medicare Audits

- Ensure accurate and complete documentation: As AI-driven audits become more prevalent, providers are prioritizing the accurate documentation of all services. Telehealth consultations must be documented with the same level of detail as in-person visits, with comprehensive patient histories, clearly outlined treatment plans, and all relevant clinical notes to ensure accuracy, continuity of care, and compliance with regulatory standards. Automated systems can quickly flag errors or inconsistencies in records, resulting in increased scrutiny. To ensure successful Medicare billing, providers must meticulously align their documentation with Medicare compliance requirements.

- Justify medical necessity of services: Providers who offer high-cost services should expect more rigorous audits and should be prepared to provide comprehensive documentation to justify the medical necessity of the services provided. Proper coding, detailed patient histories, and clear explanations of the procedures performed will be crucial in avoiding audit issues. To reduce the risk of issues, providers should ensure that documentation includes all relevant information, from the initial diagnosis and medical necessity to follow-up care. Establishing standard operating procedures (SOPs) for documenting high-cost services will be key to avoiding compliance pitfalls.

- Stay abreast of Medicare rules: As Medicare regulations are continually evolving, it’s imperative for healthcare providers to remain informed about updates that could affect their billing procedures. What healthcare providers need to know about Medicare Advantage audits is especially important, as providers engaged with Medicare Advantage (MA) plans should be particularly mindful of the increased scrutiny these plans are subject to. Precise documentation of patient diagnoses and treatments is essential to prevent payment recoupments or penalties associated with incorrect coding. Regular participation in training sessions and thorough review of updates from CMS are crucial steps in maintaining compliance.

- Conduct internal audits: In the highly regulated and scrutinized healthcare industry, conducting internal medical billing audits is essential. These audits serve as an additional layer of oversight, meticulously reviewing a practice’s billing and coding processes to ensure accuracy and compliance. By identifying and rectifying errors, internal audits help protect practices from fraudulent billing and improper claims submissions, which can lead to substantial Medicare penalties. Moreover, they pinpoint areas of risk that may attract scrutiny from Recovery Audit Contractors (RACs), enabling proactive management and mitigation of potential issues.

Leverage Expertise to Alleviate Audit Impact

In 2025, Medicare provider audits will intensify due to technological advancements, stricter compliance rules, and increased oversight of telehealth and high-cost services. Medicare audit trends indicate that providers must align their practices with Medicare standards to navigate these challenges.

To mitigate the impact of audits, Medicare has implemented initiatives to educate providers on proper billing practices and compliance requirements. A notable example is the Targeted Probe and Educate (TPE) program, which offers one-on-one assistance to help providers and suppliers reduce claim denials and appeals. Through TPE, Medicare Administrative Contractors (MACs) work directly with providers to identify errors and provide guidance on correcting them. Additionally, CMS offers various educational resources aimed at helping providers avoid common coverage, coding, and billing errors. In 2025, we can expect more training programs, webinars, and resources aimed at helping providers understand the complex rules and regulations associated with Medicare.

By engaging with these programs and utilizing available resources, providers can enhance their understanding of Medicare’s billing requirements, thereby reducing the likelihood of errors and the associated risks of audits.

Engaging with compliance specialists in a medical billing company is a practical strategy for healthcare providers to submit accurate claims in line with Medicare billing regulations. These experts assist in preparing for audits by ensuring comprehensive and precise documentation, thereby mitigating the risk of penalties associated with improper billing practices. By staying informed, enhancing documentation, and seeking professional guidance, providers can navigate the complexities of Medicare audits and safeguard their financial health.

Partner with our expert medical billing team to navigate Medicare audits confidently and maximize your revenue.