In the dynamic health insurance industry, optimizing efficiency in eligibility checks has become essential. Most healthcare providers rely on insurance verification services to ensure accuracy in patient eligibility checks. With constantly changing rules and standards, there’s always room for new strategies and improvement. Integrating advanced analytics enables verification specialists to improve accuracy and provide better services for healthcare providers and patients.

Boost and efficiency in eligibility verification with our expert insurance verification services!

Importance of Improving Insurance Eligibility Verification Accuracy

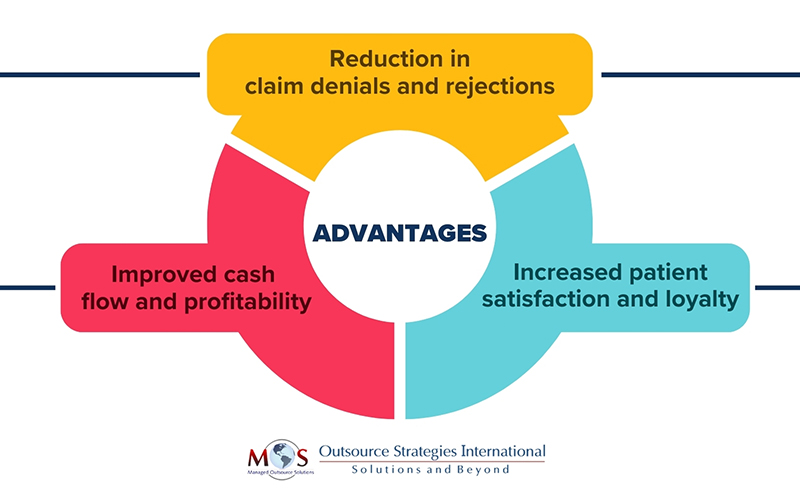

Verification of patient benefits is a crucial step in the medical billing process and brings significant advantages for a healthcare practice’s revenue cycle and overall business.

Ensuring accurate and timely verification of insurance information helps prevent issues such as inaccurate or missing patient or payer details, expired or inactive coverage, and non-covered services. This proactive approach not only saves time and money on claim resubmissions and appeals but also optimizes cash flow and profitability. It also helps enhance the patient experience by delivering clear and precise information on their insurance coverage, benefits, out-of-pocket costs, and payment options. It helps patients to understand their financial responsibilities and adequately prepare for payments, building their trust in the medical practice.

Leveraging data for continuous improvement reduces manual tasks, streamlines operations, and increases overall accuracy.

Role of Analytics in Optimizing Efficiency in Insurance Eligibility Checks

Here are the key ways an insurance verification company can utilize data analytics for continuous improvement in insurance verification:

Automation for Accuracy and Expedited Processing

Utilizing data analytics helps automate the verification of insurance information. Algorithms can be implemented to quickly check, analyze and validate policy details. Analytics can automate various processes involved in eligibility checks, such as data entry, document verification, and cross-referencing. This accelerates the process and reduces manual workload as well as potential errors, and inconsistencies.

Predictive Analytics for Risk Assessment

Predictive analytics in risk management involves the utilization of internal, external, and alternative data to recognize, evaluate, and alleviate potential risks. Policy evaluation models can evaluate factors such as claim history, coverage types, and payment patterns to predict the likelihood of potential issues or discrepancies. By integrating predictive analytics into risk assessment processes, a reliable verification company can proactively identify patterns and trends and manage potential risks associated with specific insurance policies.

Fraud Detection and Prevention

Advanced analytics tools can detect and prevent insurance fraud. By analyzing various data points, such as claim details and policyholder information, predictive analytics can detect anomalies that are indicative of potential fraudulent behavior or activities.

Customized Verification Models

Using data analytics to develop customized verification models is a strategic approach that enhances the efficiency, accuracy, and adaptability of the verification process. Analyzing historical data can identify patterns related to successful verifications, common discrepancies, and trends in data accuracy. Customized verification models can be developed based on this historical data and specific client requirements. This can lead to more accurate and efficient verification processes.

Real-time Data Analysis

Instantaneous verification checks can be performed by leveraging real-time data analytics. Algorithms continuously analyze incoming data, adjusting risk evaluations based on the most up-to-date information, ensuring accurate risk management. Analyzing data in real-time allows for quick decision-making and enhances the speed of verification processes. It also enables immediate detection of potential fraud to minimize risks and safeguard the integrity of the patient eligibility verification process.

Compliance Management

Compliance and Quality Assurance (QA) are essential, ensuring accurate, ethical processes aligned with industry regulations like the Health Insurance Portability and Accountability Act (HIPAA) and the Affordable Care Act (ACA). These laws safeguard patient privacy, ensure data security, and establish guidelines for insurance coverage and claims processing. Implementing analytics tools can also ensure compliance with regulatory requirements. Regularly monitoring changes in regulations and adjusting verification processes accordingly can help avoid legal issues and penalties.

Utilizing Reporting Tools

Utilizing reporting tools for continuous improvement can enhance efficiency, accuracy, and overall performance. Reporting tools provide a comprehensive view of key performance metrics such as verification turnaround time, accuracy rates, and resource utilization. Analyzing the reports can identify bottlenecks, areas where delays occur or where resources are underutilized, and inefficiencies in the verification workflow. Leveraging reporting tools empowers companies to stay agile, proactive, and at the forefront of the evolving insurance landscape.

Continuous Improvement through Feedback Loops

Implementing feedback loops for continuous improvement is critical for addressing errors quickly and adapting to the changing regulatory landscape. Analytics provides insurance companies with valuable insights and feedback on their eligibility check processes. By analyzing data on rejected applications and claims outcomes, verification specialists can identify areas of improvement and take steps to optimize efficiency over time.

Overall, data analytics, reporting tools and feedback mechanisms can help insurance verification companies make informed decisions, continuously improve their processes, and better serve healthcare providers and patients.

Optimize patient eligibility verification, reduce errors and ensure compliance!