The efficiency and accuracy of administrative processes play a crucial role in providing quality patient care. One such critical aspect is verification of patient benefits, a process that ensures healthcare providers have accurate and up-to-date information about a patient’s insurance coverage. The traditional methods of manual verification are time-consuming and prone to errors, leading to delayed reimbursements and increased administrative burdens. The integration of technology into insurance verification services has become indispensable in hospital settings, significantly transforming and optimizing the entire process.

Dive deeper into the importance of insurance verification services!

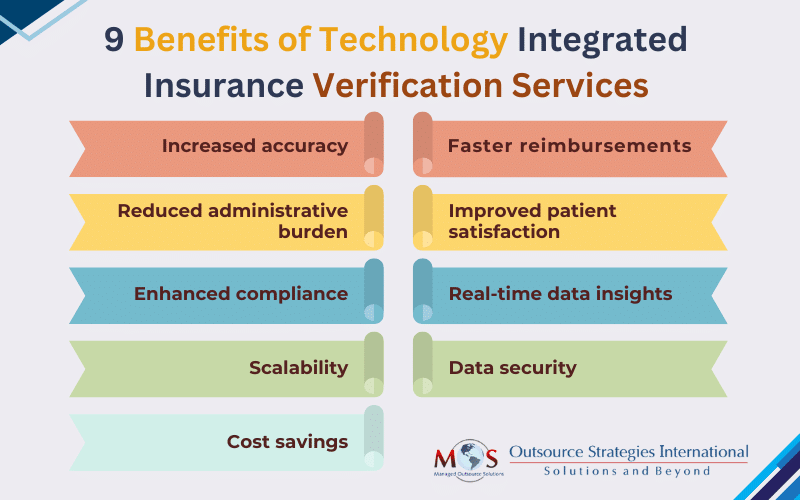

The importance of using technology lies in its ability to streamline operations, enhance accuracy, and ultimately improve patient care. Automated insurance verification services provide real-time access to patient data, ensuring that healthcare providers have the most up-to-date and accurate information regarding insurance coverage and benefits. This reduces the risk of claim denials and accelerates the billing process, contributing to quicker reimbursements. The integration of these services with hospital information systems and electronic health records (EHRs) enhances workflow efficiency, minimizes administrative burdens, and fosters a more organized and productive environment. Proper insurance verification can also significantly improve patient satisfaction by reducing financial anxiety, avoiding surprise bills, and increasing transparency in costs.

Let’s discuss about increasing accuracy by utilizing technology in the insurance verification process.

Explore our insurance verification services!

Take the first step toward a streamlined and profitable practice.

How Technology Integrated Insurance Verification Services Support Medical Billing

The integration of technology into eligibility verification has emerged as a game changer, revolutionizing the way healthcare providers handle this vital task.

Automation for speed and precision: One of the primary benefits is the automation of the entire process. Advanced software and systems can quickly and accurately verify patient insurance details, eliminating the need for manual data entry. This saves time and significantly reduces the risk of errors associated with human input, ensuring precision in the verification process.

Real-time access to payer information: Technology provides healthcare providers with real-time access to payer databases, allowing instant verification of insurance information. This real-time access ensures that the data is always current and up-to-date, minimizing reliance on outdated or inaccurate information. The ability to retrieve the most recent data contributes to more accurate billing and reduces the likelihood of claim denials.

Enhanced workflow integration: Smooth integration with practice management systems and electronic health records (EHRs) is a key advantage of technology-driven services. When these systems work in harmony, there is a reduction in duplicate data entry, minimizing administrative burden, promoting consistency in records, and enhancing overall workflow efficiency.

Reduction in claim denials: Inaccurate or outdated insurance information often leads to claim denials, causing financial strain on both patients and healthcare organizations. AI-integrated automated solutions act as a proactive measure to identify potential issues before claims are submitted, thereby reducing the risk of denials and ensuring a smoother revenue cycle.

Improved patient communication: Technology also facilitates clear and transparent communication with patients regarding their insurance coverage. Automated systems can generate patient-friendly explanations of benefits, helping individuals understand their financial responsibilities upfront. This not only fosters trust but also contributes to improved patient satisfaction.

Adherence to regulatory compliance: With ever-evolving healthcare regulations, staying compliant is paramount. Technology ensures that insurance verification processes adhere to the latest industry standards and regulatory requirements. This reduces the risk of non-compliance issues and potential legal repercussions for healthcare providers.

Best Tools for Insurance Eligibility Verification

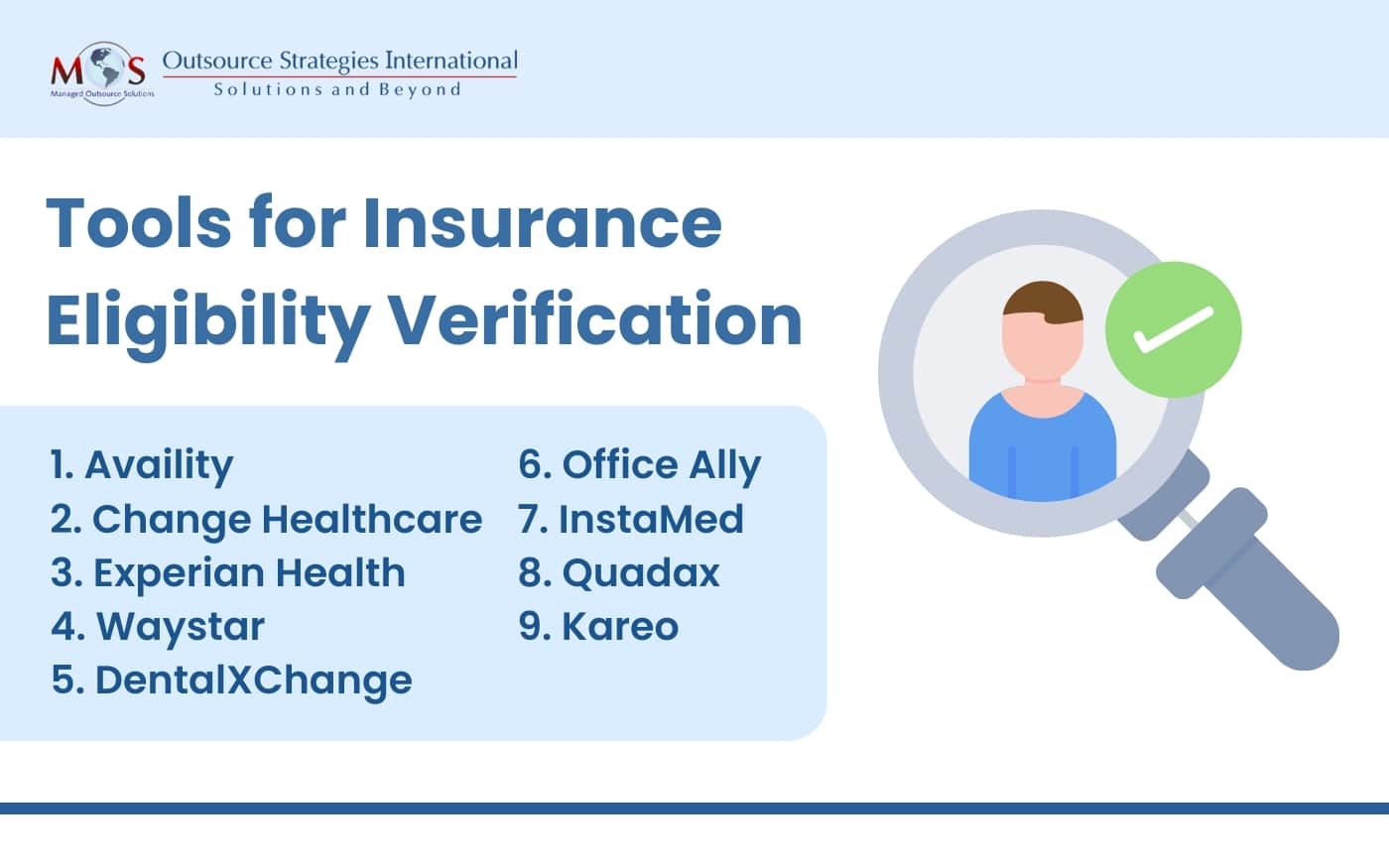

Several tools and software solutions are available to assist healthcare providers in streamlining and improving insurance eligibility verification. These tools are designed to enhance accuracy, efficiency, and overall workflow.

Here are some of our favorite tools for insurance eligibility verification:

When choosing an insurance eligibility verification tool, it’s essential to consider factors such as integration capabilities, real-time functionality, user interface, and compatibility with existing systems.

From automation and real-time access to enhanced workflow integration, the benefits of technology in eligibility verification are multifaceted. Embracing these technological advancements improves operational efficiency and contributes to better patient care, making it a key component in the modern healthcare landscape. It is crucial for healthcare practices to choose an insurance verification company that works at least 3 days ahead of the scheduled appointment so that practices have the time to provide their patients’ benefits before the visit.

Say goodbye to claim denials!

Discover the benefits of our advanced insurance verification services!.