Hospitals and other healthcare organizations are under continuous financial stress and various operational challenges in the post COVID-19 era. Among them, medical necessity denials is a persistent issue that continues to rise as commercial payer percentage of medical necessity inpatient claim denials surged from 2.4% to 3.2%. This adds to overload of administrative work to your practice’s staff as they have to simultaneously manage claim submission and claim denials.

The term “medically necessary” generally refers to care that is reasonable, necessary, and/or appropriate, based on evidence-based clinical standards of care. Medicare and private payers regard medical necessity as a deciding factor for claims payment. The interpretation and application of medical necessity can vary based on payer policies. With its inherent specificity requirements, ICD-10 has increased the potential for medical necessity denials. Medical billing and coding outsourcing companies can ensure accuracy in coding and claims processing only if the documentation captures the actual severity of illness and its intensity.

Medical necessity denials are often more complex due to the insurance providers refusing to consider a medical procedure or service performed as necessary, even if the healthcare provider deems it a necessity. Health plans have clinical guidelines that determine “medical necessity”; however, no amount of guidelines can wholly cover the unique medical facts and circumstances of each patient. Payers might also decline a claim due to the reasons below:

- Missing prior authorization

- Inaccurate and deficient documentation

- Medical necessity requirement not met

- Coding errors

- Experimental treatments such as cosmetic are not classified as medical necessity by payers

- Coverage for certain procedures simply not offered by payers

- Healthcare provider is out of network

- The claims filed exceed the length of stay approved by payers

Lighten your load by hiring our expert claim denial and RCM team to handle your practice’s medical necessity claims!

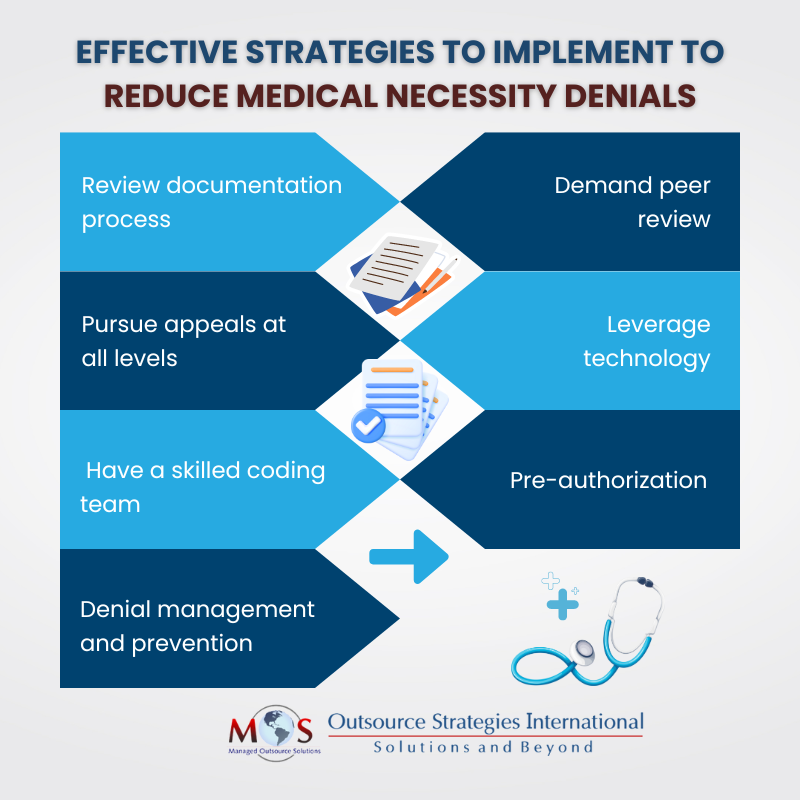

Strategies to Navigate Denials Based on Medical Necessity Decision

Medical necessity denials can be irksome and time-consuming. As per Change Healthcare research, it accounts for 5% of denials nationwide. Denials are an inevitable part of RCM, so while it is impossible to stop claim denials, reducing the percentage of denials to minimum is possible. Having a denial prevention management strategy in practice can help identify the root cause of denials, steps that should be taken to mitigate this issue, and reduce the amount of denials to lowest value.

The following strategies can be implemented to effectively navigate medical necessity denials:

- Review documentation process:

Medicare, Medicaid and other private insurers have set their own set of criteria defining whether a medical procedure conducted on a patient is medically necessary or not. The base of every successful claim processing is accurate, thorough clinical record documentation that demonstrates the patient’s symptoms, medical history and holistic understanding of the treatment given to the patient. It is vital to eliminate unnecessary features that contribute to substandard documentation like incomplete and copy and paste description, inaccurate templates, lack of specific patient conditions and errors in medical information of patient.

The ever-changing rules and regulations set by governmental bodies and private payers for medical services are a major concern. These policies are available in the payers’ payment policies or clinical guidelines. The coverage policies for Medicare includes NCDs (National Coverage Determination), which are nationwide determinations for Medicare-covered services and Local Coverage Determinations (LCDs) or determinations if a service is covered carrier-wide by a MAC (Medicare Administrative Contractor). Providers can ask insurers for their state’s clinical criteria that are used to make treatment decisions and review them for relevance and accuracy. This will help develop a better case against exceptions that the payer makes to this type of guidance.

Suppose a patient comes in with a compliant of chest pain, but the physical exam reveals severe gangrene in the left foot for which he is admitted. In this case, the list of diagnoses should include a note pertaining to the chest pain – which could be precordial catch syndrome (PCS) or a sign/symptom of chest pain with the exact location specified. The H&P must justify the patient’s risk of mortality and the possibility of an untoward event. The H&P should have: the chief complaint, associated signs and symptoms, and history of present illness (HPI).

According to an Experian Health survey, more than 100,000 payer policy coding and reimbursement updates were made between 2020 and 2022 so it is imperative that providers stay abreast of each payer’s latest coverage criteria and requirements while documenting the entire medical process. With the support of sophisticated technology, payers are now equipped to identify and flag any single mistake in the document. This makes accurate documentation more important than ever.

- Demand peer review

The initial medical documentation has room for improvement and demanding a peer review from a billing specialist with a strong background in documenting will help to identify any issues. The appeal reviewer also vindicates the need of medical necessity that improves the success of claim processing. However, the access to appeal reviewers, especially sub-specialty reviewers is not always available readily and this can cause delays especially if you need a board-certified sub-specialist. So, your appeal should mention the specific credentials that the reviewer must possess before filing for peer review. A well-drafted rebuttal report can increase the physician’s likelihood of success in litigating the denied claims.

- Pursue all levels of appeal

Most insurers, including Medicare and Medicaid, have multiple levels of appeals. Usually on the private insurer’s side, providers are limited to 1 or 2 internal appeals. With the patient’s permission, you can pursue all levels of appeals and importantly, strive for higher-level appeal reviews to overturn mediocre appeal review components obtained at the lower levels of review. State departments of insurance and the Affordable Care Act (ACA) have granted consumers the right to an independent, external third level appeal of adverse coverage determinations by their health plans for issues such as medical necessity. Independent medical record review companies have professional medical review staff to meet the challenge of reviewing cases.

For instance, Original Medicare has five levels of appeal, each with its own unique requirements:

- Level 1 – Redetermination by a Medicare Administrative Contractor (MAC)

- Level 2 – Reconsideration by a Qualified Independent Contractor (QIC)

- Level 3 – Hearing before an Administrative Law Judge (ALJ)

- Level 4 – Review by the Medicare Appeals Council

- Level 5 – Judicial Review in United States District Court

Providers should submit complete medical documentation signed by the attending physician along with the appeal to overturn a medical necessity decision. The appeal letter should specifically address the objections raised in the denial letter. It should include information to support the initial codes, official coding guideline references and specific notation of record documentation location, and relevant clinical findings.

- Leverage technology

Employ the use of technologies such as Electronic Health Record (EHR) in your practice to streamline the up-to-date, complete patient information process, reduce medical errors, enable seamless exchange of patient details between departments and improve the overall efficiency in your patient care. Upgrade to incorporate new procedures, diagnosis and codes on the billing software in your practice with a built-in claim scrubber to review the data and flag claims missing any important information or having coding errors. Claim scrubber also ensures that the claims meet all nationally accepted latest coding standards. Outdated systems can cause errors and delays in billing and coding.

However, a claim scrubber can never replace a qualified human coder as it is a tool to detect and eliminate common repetitive errors; so, educate your staffs on the latest claim scrubber software. This also increases the productivity of the workflow in your practice and ensures the success of claims on the first submission as well.

- Have a skilled coding team

Medical coders translate the clinical documentation into codes which insurance companies use to determine if the services were medically necessary. Coders should therefore be aware of the medical necessity implications of the codes they report and how coding impacts the revenue cycle. They should be knowledgeable about local coverage determinations (LCDs), national coverage determinations (NCDs), and payer policies. Outsourcing medical coding to an experienced company can ensure that coding errors don’t cause medical necessity denials.

ICD-10 requires coding to the highest level of specificity, making it critical that the details provided in the medical record are accurate and precise. To ensure that the medical coding company can provide the most precise codes for methodologies such as DRGs, HCCs, etc. physicians should specify severity, specificity, laterality, and linkage. This will provide a true picture of the patient’s condition.

- Prior authorization

Providers should ideally have an insurance verification company to verify and validate patients’ benefits and demographic information and obtain referrals and prior authorizations. The services of an insurance verification specialist can go a long way in preventing medical necessity related denials.

- Denial management and prevention

The goal of every claim submission is receiving the receipt of payment for the services rendered. However, even after doing everything correctly, denials are sometimes inevitable which means loss in revenue. That is why it is advisable to utilize a denial management and prevention department for your practice. Claims management should be entrusted to a robust team of experts that perform the following systematic process for finding, reviewing and resolving denials:

- Identify the denials

- Analyze the root cause and categorize the denials

- Resolve the denials issue

- Submit the appeals

- Monitor the denial rates

- Implement denial prevention plans

Relevant and timely initiatives must be taken for resubmission of denied claims. while designing and creating preventive measures to proactively reduce the amount of denied claims. This will minimize revenue leakage and enhance the overall revenue cycle management process. The leading strategy for preventing denials is automating the process with the use of denial claims management software. By investing in technology solutions, you can minimize manual, human-made errors that result in denials. Stay vigilant of the denial trends and tackle the issues with strategic aims to prevent denials.

Getting claims paid requires teamwork. Physicians, coders, and billers must work as a team to meet all the requirements for proper claims submission and payment. Medicare has guidelines for local coverage determinations (LCDs) and national coverage determinations (NCDs) Third-party payers also have specific coverage rules as to what they consider medically necessary or have riders and exclusions for specific procedures. Familiarity with these rules is crucial for accurate claim submission. Outsourcing medical billing and coding to a reliable service provider is the ideal option to ensure error-free documentation to support medical necessity, ensure precise coding, prevent denials, and receive optimal reimbursement.