The comprehensive revenue cycle management solutions that leading medical billing companies provide cover everything ranging from patient registration and insurance verification services to coding and collections management. According to recent research from public accounting, consulting, and technology firm Crowe, patient access and medical billing and collections are among the top healthcare revenue cycle risk areas for healthcare providers in 2019. The firm stressed that early detection and preparation is the best way to alleviate these risks.

The researchers defined a risk area for hospitals, physician practices, and other healthcare organizations as anything that might impede the provider’s “ability to achieve its goals in critical areas such as patient care, regulatory compliance, operations, strategic growth, and financial performance.”

The study noted that as medical billing is a core function in provider organizations, they should ensure clean claims submission and timely collection of reimbursement. However, the study identified major risks related to billing practices and collections management, which were discussed in a December 2018 article in Revenue Cycle Intelligence. Let’s take a look at the new revenue cycle management (RCM) trends and requirements healthcare providers have to deal with in 2019:

-

- Medical billing and coding concerns: Medical billing concerns identified include:

- Incomplete and inaccurate medical billing

- Increased claim denials

- Inadequate denials management

- Costly reworking of claims

- Lost reimbursement

The basic errors that can get a medical claim returned are:

- Errors in information about the patient (Sex, name, DOB, insurance ID number, and other insurance-related information, etc.), provider (address, name, contact information, etc.), and insurance provider (policy number, address, etc.).

- Medical coding errors such as reporting the wrong ICD-10, CPT and HCPCS codes, leaving out codes altogether, undercoding, upcoding, using wrong Place of Service (POS) codes, and wrong modifier use.

- Duplicate billing – submitting a claim for a procedure without checking whether that service has been paid for/reported.

- Sloppy documentation – Claims will be returned as inaccurate or incomplete if the documentation of a procedure or patient visit is incorrect, illegible, or incomplete documentation.

- Medical billing and coding concerns: Medical billing concerns identified include:

Providers need to be aware of these errors and take steps to avoid them.

-

- Prior authorization requirements: The Crowe researchers also noted that healthcare organizations should be vigilant about prior authorization requirements and insurance verification in 2019. Here are some examples: Blue Cross Blue Shield Minnesota has published the following update on prior authorization requirements for Blue Cross Medicare Advantage on their website effective January 1, 2019. Changes listed:

- Prior authorization required for all planned and unplanned medical and behavioral inpatient admissions

- Non-emergent ground and air ambulance

- Ancillary Services (chiropractic and outpatient therapies) – PA required from the first visit (after initial evaluation)

BCBS also has several new PA requirements for 2019.

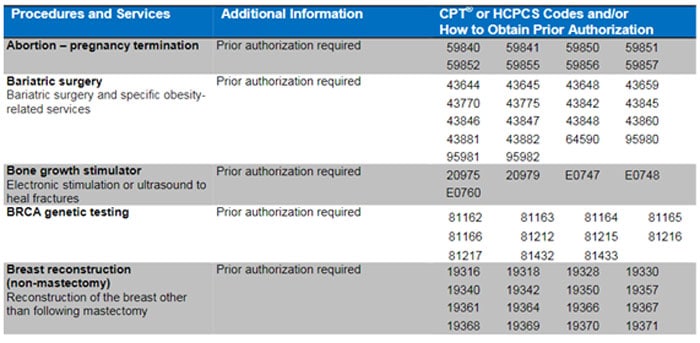

United Healthcare’s list contains prior authorization requirements for the United Healthcare Community Plan in Ohio participating care providers for inpatient and outpatient service. Here are some of these procedures and services in this list:

- Prior authorization requirements: The Crowe researchers also noted that healthcare organizations should be vigilant about prior authorization requirements and insurance verification in 2019. Here are some examples: Blue Cross Blue Shield Minnesota has published the following update on prior authorization requirements for Blue Cross Medicare Advantage on their website effective January 1, 2019. Changes listed:

Source: https://www.uhcprovider.com/content/provider/en/viewer.html?file=%2Fcontent%2Fdam%2Fprovider%2Fdocs%2Fpublic%2Fcommplan%2Foh%2Fprior-auth%2FOH-UHCCP-PA-Effective-1-1-2019.pdf

The researchers stress that to prevent disruptions to medical billing processes and ensure seamless patient care, providers need to proactively verify insurance and check for prior authorizations (PAs).

- Patient access: Patient access is another risk area in 2019, according to the Crowe survey. Providers will need to provide convenient care options and other patient services to drive more patient access to healthcare. The researchers recommend controls over patient scheduling, registration, and making admission processes rigorous to minimize the risk of billing and patient accounting issues, lost revenue, and poor patient and physician satisfaction. Patient access risks can also be mitigated by ensuring that information collected during the scheduling, preregistration, and registration processes is complete and accurate. Processes should include checking medical necessity for outpatient services and providing estimates of cost and patient liability.

- Patient financial responsibility: Patient financial responsibility or the amount of out-pocket costs that patient incur has increased considerably in recent years. The study recommends that, in 2019, healthcare providers should collect patient financial responsibility upfront. The researchers advised that financial counselors should meet with all uninsured patients prior to discharge to discuss patient financial responsibility and help patients identify and apply for insurance or other healthcare support.

- Charge capture: Many health care providers fail to capture all charges for care services or supplies, leading to losses amounting to millions of dollars in income. EHRs and other patient care subsystems are the basis for charge capture, interfacing with providers’ billing and coding systems to generate patient bills. The researchers stress that organizations must establish charges, code medical records, and bill claims in compliance with rules established by Medicare and other payers. As they implement new technologies and provide high-cost procedures and services in 2019, provider organizations must pay attention to ensuring the accuracy and completeness of their charges.

Finally, the study found that another major risk area for provider organizations relates to managing their medical billing service provider. Today, most healthcare providers rely on third party vendors to reap cost savings and operational efficiencies. However, the researchers point out that organizations need to carefully consider the risks involved in outsourcing RCM before they sign the contract with a third party vendor. If they do decide to rely on outsourced medical billing and coding services, they would need to keep an eye on their vendor’s performance to ensure accurate, timely claims.

Partnering with an experienced medical billing and coding company is the answer to meeting most of these RCM challenges. A reliable company would be up to date with the latest codes and billing rules and help provider organizations submit clean claims for optimal reimbursement. Such vendors would also provide medical billing analyses and reports to help practitioners monitor their financial performance and improve on it.