Integrating sustainability into a business strategy has become a necessity. Adopting a value-driven approach in business strategies is essential for ensuring long-term success. In the insurance industry, there is a growing emphasis on reducing environmental impact through green insurance verification.

Get tailored insurance solutions that align with the unique needs of your practice.

Green Practices in Healthcare Insurance Verification

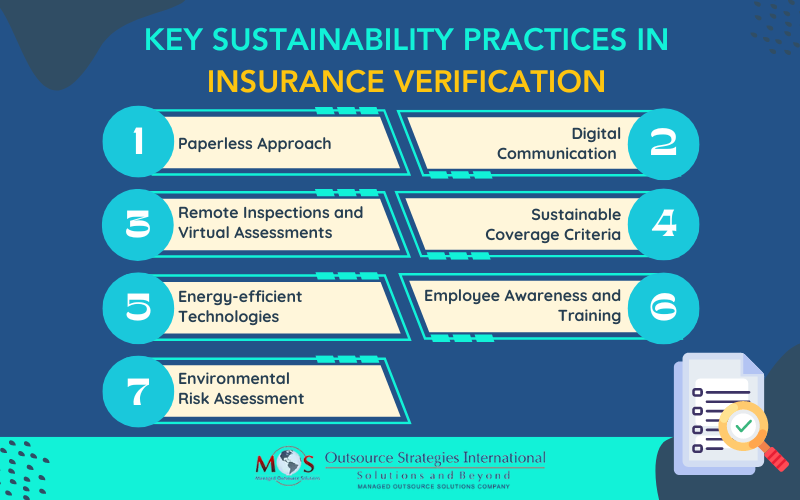

Here are key sustainability practices that contribute to greener and more eco-friendly insurance verification:

Paperless Approach

Health insurance claims typically come with an overwhelming amount of documentation. From medical records and bills to policy details and procedural documents, the sheer volume can lead to delays, errors, and increased administrative burdens for both insurance companies and policyholders. Green insurance verification minimizes paper usage by moving processes to digital platforms, such as online portals and electronic document management systems. Embracing a paperless approach not only reduces the environmental impact, but also improves efficiency and accessibility.

Digital Communication

Using digital channels like emails and secure online portals not only makes verification faster but also reduces the environmental impact of traditional mail. Real-time updates and electronic communication contribute to a more eco-friendly and responsive verification system.

Remote Inspections and Virtual Assessments

Green insurance verification also supports remote inspections and virtual assessments, reducing the need for physical site visits. For instance, by leveraging technology such as online portals and phone calls, an insurance verification company can help healthcare providers remotely verify patient eligibility and benefits. Online and phone verifications minimize travel-related carbon emissions, lowers costs, and expedite the verification process. Additionally, virtual assessments for telemedicine enable insurance verification specialists to reach remote and inaccessible locations. Quicker remote checks save time and effort for patients.

Sustainable coverage criteria

Green insurance verification includes considering sustainability in coverage assessments. Insurance providers can create guidelines that motivate policyholders to adopt eco-friendly practices. For instance, a green insurance policy might give discounts to businesses using energy-efficient technologies or practicing sustainable waste management. Implementing these actions help insurers support the environment and promote positive change.

Energy-efficient technologies

Incorporating energy-efficient technologies is a crucial aspect of sustainable practices. This includes optimizing server usage, utilizing energy-efficient hardware, and exploring renewable energy sources for data centers. By reducing energy consumption, companies can contribute to a lower carbon footprint.

Collaboration with environmental NGOs, research institutions, and sustainability-focused companies can lead to the development of innovative insurance products, improved risk management strategies, and increased awareness of sustainable practices within the industry.

Employee awareness and training

Building a culture of sustainability within the organization involves educating employees about the importance of green practices. Training programs on eco-friendly procedures and the significance of sustainability contributes towards responsible environmental practices.

Environmental risk assessment

Green insurance verification focuses on evaluating environmental risks, such as climate change, natural disasters, pollution, habitat destruction, and resource depletion. Insurers conduct thorough assessments to understand the risks faced by policyholders and provide appropriate coverage and risk management strategies. By integrating sustainability into risk assessment, insurers can anticipate and mitigate potential losses, protecting policyholders and contributing to a resilient and sustainable society.

Interested in staying up-to-date with the latest trends in insurance verification?

Read our post: Emerging Trends and Innovations in Insurance Verification.

Sustainable Approaches to Insurance Eligibility Checks in Medical Practices

Adopting sustainable approaches to insurance eligibility checks in medical practices can improve the process while minimizing environmental impact.

One example of a sustainable approach is the utilization of electronic methods for verifying insurance eligibility. Instead of relying on paper-based documentation and manual processes, medical practices can leverage electronic systems that allow for efficient verification of insurance coverage. These systems can access real-time insurance information, reducing the need for printing and mailing documents. By embracing sustainable approaches, medical practices can improve operational efficiency, reduce paper waste, and contribute to environmental conservation.

Implementing strategies for environmentally conscious insurance verification services are not just a trend but a necessity. As the insurance industry and medical practices adapt to a changing world, incorporating these eco-friendly measures not only aligns with global environmental goals but also enhances the reputation and corporate responsibility of insurance providers. By supporting green insurance verification practices, insurance companies can also encourage sustainable actions among policyholders, contributing to a sustainable future for the planet while maintaining efficiency and reliability.

Resolve the administrative insurance verification with our specialized insurance verification services.