Telehealth has experienced widespread adoption and growth in recent years due to several factors, such as accessibility and convenience, expanded healthcare reach, continuity of care, improved healthcare efficiency, remote monitoring and chronic disease management, and cost savings. Advancements in technology, including high-speed internet connectivity, secure video conferencing platforms, and electronic health record have improved the quality and reliability of telehealth services, making them more accessible and user-friendly. As telehealth adoption continues to grow, remote insurance eligibility verification services are a reliable way to confirm a patient’s insurance coverage and eligibility without the need for an in-person visit.

Partner with us for a hassle-free insurance verification process for telehealth services!

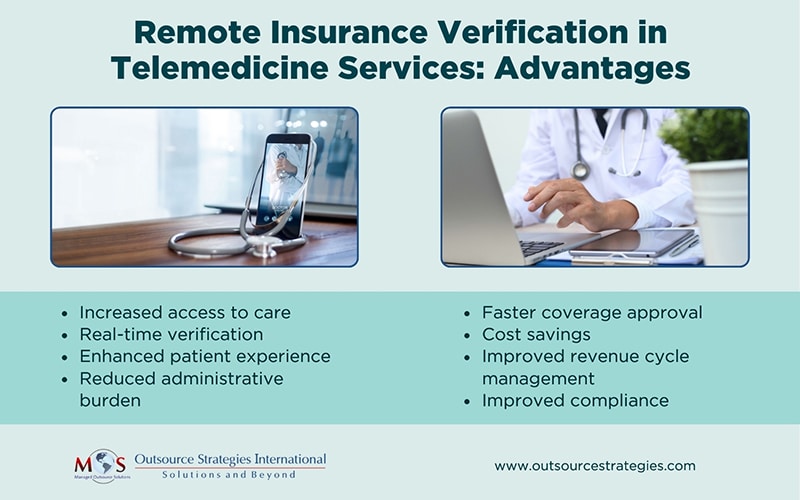

Benefits of Remote Insurance Verification in Telemedicine Services

Whether care is provided hands-on or via telemedicine platforms, verifying patient coverage before services are rendered is crucial. Remote insurance verification offers several benefits for both patients and healthcare providers.

Here are some key advantages:

Increased access to care

Telemedicine services combined with remote insurance verification eliminate geographic barriers, enabling patients in remote or underserved areas to access quality healthcare. This is particularly beneficial for patients who face challenges in traveling long distances or have limited access to local healthcare facilities.

Real-time verification

Remote insurance verification often occurs in real-time, allowing immediate feedback to both the patient and the healthcare provider. This ensures that both parties are aware of any potential coverage limitations or out-of-pocket costs before the telemedicine appointment.

Enhanced patient experience

Remote insurance verification enhances the patient experience by minimizing delays and ensuring that insurance-related matters are promptly addressed. Patients don’t need to physically visit their physician’s office or submit paper documents. By allowing them to access services more conveniently from the comfort of their own homes, the remote checks save time and effort for patients.

Reduced administrative burden

Traditional insurance verification often involve significant paperwork, phone calls, and manual data entry. With telemedicine, patients provide their personal and insurance information through secure online platforms or portals. Using secure online platforms, healthcare facilities can verify a patient’s insurance information in real-time, ensuring accuracy and preventing potential billing issues. By automating much of the process, this service reduces administrative tasks and frees up staff to focus on patient care.

Faster coverage approval

Remote insurance verification enables real-time verification of insurance coverage, resulting in faster approvals. This improves and expedites the overall patient experience, allowing them to obtain necessary medical consultations and treatments without delays.

Cost savings

Remote insurance verification can lead to cost savings for both patients and healthcare providers. Patients can save on transportation costs associated with in-person visits, while healthcare providers can reduce administrative expenses related to manual verification processes.

Improved revenue cycle management

Real-time insurance verification minimizes the risk of providing services to patients with expired or insufficient coverage, ensuring timely and accurate reimbursement for telemedicine services. Remote insurance verification optimizes revenue cycle management by reducing claim denials and rejections.

Improved compliance

By integrating necessary compliance checks, remote insurance verification systems can reduce the risk of billing errors or non-compliance with insurance guidelines.

Curious about the latest trends in insurance verification?

Dive into our post on Emerging Trends and Innovations in Insurance Verification.

Many remote insurance verification solutions can integrate seamlessly with telemedicine platforms and electronic health records (EHR) systems. This integration streamlines the overall workflow, allowing healthcare providers to access insurance information within the telemedicine platform itself.

It’s important to note that these benefits may vary depending on the telemedicine platform and verification system being used, as well as the policies and guidelines of individual insurance providers. Healthcare organizations considering the implementation of remote verification should evaluate different solutions and implement the option that aligns with their specific needs and objectives.

Importance of Human Expertise in Remote Patient Eligibility Verification

While automated systems excel at real-time patient eligibility verification, human expertise is still important for ensuring accuracy in insurance eligibility checks for remote healthcare. An insurance verification specialist will communicate directly with insurance companies in order to address discrepancies or acquire additional information.

These specialists will meticulously examine the patient’s insurance policy, taking into account recent updates or changes. Their expertise allows them to identify nuances within the policy that an automated system might overlook, such as specific exclusions or limitations related to the relevant procedure. Through direct communication with the payer, they ask questions and furnish essential documentation, ensuring precise verification of coverage. Furthermore, human specialists bring a wealth of experience and expertise in navigating intricate insurance policies and guidelines. Their ability to interpret and apply insurance rules and regulations is more effective, resulting accurate remote insurance verification services, minimizing the potential for claim denials or delays.