Insurance verification is the procedure of checking and validating a patient’s insurance plan details. This important step in the medical billing process involves determining the active status of the patient’s policy and understanding the details of the coverage, including services, treatments, and medications. It also helps medical practices understand the patient’s financial obligations, such as co-pays, deductibles, and out-of-pocket maximums. Typically, insurance verification is carried out by dedicated billing personnel in a healthcare provider’s office, a third-party medical billing company, an automated system, or a combination of these options. This blog discusses why it’s important to conduct insurance verification before services are provided.

Save time, avoid surprises, and streamline your revenue cycle with our comprehensive insurance verification services!

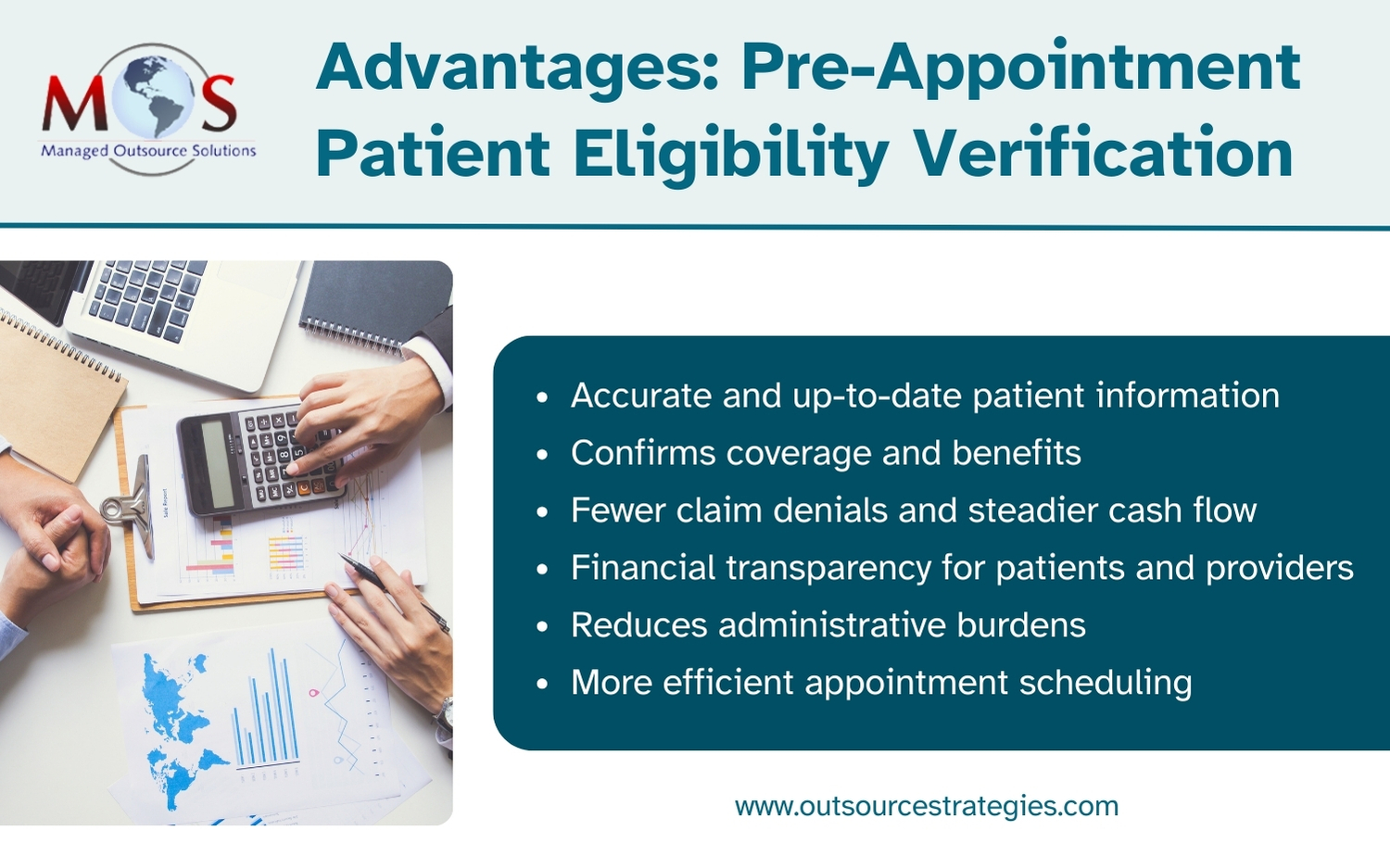

Advantages of Pre-Appointment Patient Eligibility Verification

Pre-appointment patient insurance verification plays a vital role in the smooth operation of healthcare practices. This process ensures that healthcare providers are informed about the extent of coverage for the services they are about to provide under the patient’s insurance plan. This information is important to ensure a seamless experience for both patients and providers.

Here are several reasons why pre-appointment patient insurance verification is important:

Accurate and up-to-date patient information

Insurance policies and coverage details can change frequently. Verifying patient insurance information before their appointment allows healthcare providers to ensure that they have the most up-to-date and accurate information on file. This includes verifying the patient’s insurance plan, policy number, coverage dates, and any specific requirements or limitations.

Confirms coverage and benefits

Insurance verification helps healthcare providers confirm the patient’s coverage and benefits. By verifying the patient’s insurance plan, providers can understand which services are covered, any co-pays or deductibles that apply, and any pre-authorization requirements.

Pre-appointment insurance verification ensures breakdowns are completed and the patient is aware of out-of-pocket responsibility. This helps avoid misunderstandings and surprises regarding insurance coverage. For example, suppose a patient expecting a medical procedure to be covered later discovers certain elements, like medications or post-operative care, are not included. The misunderstanding might occur due to unclear policy details, exclusions, or changes in coverage that the patient was not aware of. This lack of clarity can result in unexpected out-of-pocket expenses, emphasizing the need for thorough insurance verification to avoid surprises.

Fewer claim denials and steadier cash flow

When insurance coverage is verified and confirmed prior to providing services, healthcare providers can avoid claim denials due to issues like inactive policies, lack of coverage for a particular service, or failure to obtain prior authorization. With the correct insurance details on file, clean claims can be sent out right away, so that they are processed correctly and in a timely manner. They are more likely to receive payments from insurance companies in a timely manner, which is crucial for maintaining healthy cash flow.

Financial transparency for patients and providers

By verifying coverage in advance, providers can inform patients of their financial responsibilities or out-of-pocket expenses they may incur, such as co-pays or deductibles. This transparency empowers patients to make informed decisions about their healthcare and budget accordingly, promoting patient satisfaction and trust in their healthcare provider.

By collecting out-of-pocket payments upfront, the healthcare provider can minimize the time between the service being provided and the patient settling their financial obligations. This helps reduce the duration during which outstanding balances or unpaid amounts which are the responsibility of the patient, improving the efficiency of the revenue cycle and ensuring a more timely and predictable cash flow.

Reduces administrative burdens

Pre-appointment insurance verification reduces the administrative burden for medical practices. Ensuring that claims are submitted correctly the first time minimizes the need for addressing denied claims and chasing payments after services have been rendered.

More efficient appointment scheduling

Healthcare providers can optimize their appointment schedules by knowing in advance which services are covered. For example, consider a clinic offering physical therapy services. When the provider knows in advance which insurance plans cover physical therapy and which do not, they can they can optimize their appointment schedules. They can focus on providing services to patients whose physical therapy sessions are likely to be covered, and allocate more time and resources to treating them. Focusing on services that align with patients’ insurance coverage minimizes last-minute cancellations, and can result in better quality care and improved patient outcomes.

Outsource Insurance Verification – Streamline Patient Billing and Claim Submission

Pre-appointment insurance verification enhances transparency in the billing process. Patients are made aware of their financial responsibilities early on, and providers can ensure that their billing practices are in line with the coverage provided by insurance companies. Outsourcing front-end insurance verification and authorization services to an experienced medical billing company like OSI can ensure that that your patient eligibility checks are efficiently completed prior to the first appointment.

Boost cash flow with efficient pre-appointment insurance verification!

Call (800) 670-2809 to speak with our expert today!