The insurance industry is undergoing a significant transformation driven by technological advancements and changing consumer expectations. Staying ahead of the curve is crucial for efficient and secure operations. Emerging trends and innovations in insurance verification are reshaping the way insurers manage data, interact with clients, and ensure the integrity of their service. This post explores four innovations shaping the future of insurance eligibility checks – blockchain, remote insurance verification, machine learning (ML) and predictive analysis, and green protocols.

Enhance patient satisfaction and optimize your revenue cycle with accurate insurance verification!

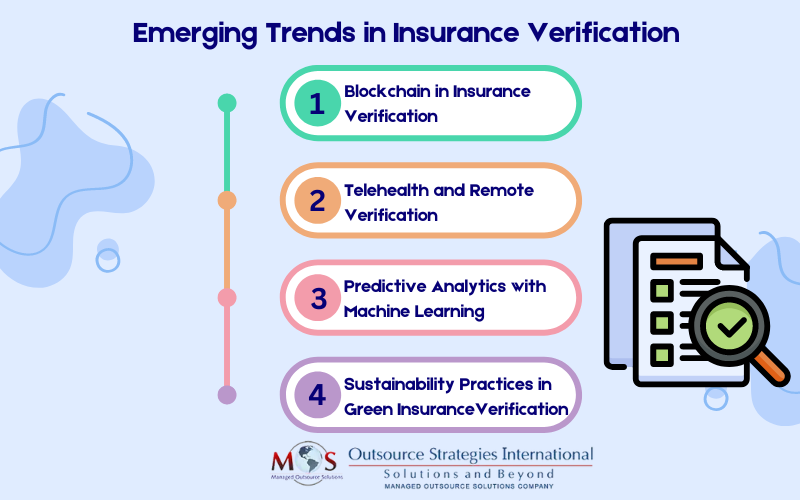

Latest Trends in Insurance Verification

- Blockchain

Blockchain has revolutionized the security of insurance verification data. By using cryptographic techniques, it ensures the accuracy and integrity of information while minimizing fraud. Once data is recorded in a block, it cannot be altered or deleted without detection, reducing the risk of unauthorized changes. Blockchain’s transparency and traceability features provide a clear audit trail for insurance verification transactions. Smart contracts further enhance the process by automating tasks like identity verification, policy validation, and claims processing. This automation ensures that all parties have access to real-time and tamper-proof data, improving integrity. It also simplifies the workflow for insurers and clients, making the entire process more efficient.

- Telehealth services and remote insurance verification

The increasing use of telehealth services has transformed how insurance verification is done. Insurers and insurance verification companies now rely on telehealth platforms that are integrated with insurance verification systems to remotely confirm patient coverage for telehealth appointments. Combining telemedicine services with remote verification removes geographic barriers, making it possible for patients in remote or underserved areas to receive high-quality healthcare. Patients no longer have to physically go to their doctor’s office or submit paper documents for insurance verification. This not only saves them transportation costs associated with in-person visits but also helps healthcare providers reduce administrative expenses involved in manual verification.The remote insurance verification process often happens in real-time, enabling faster approval for telemedicine services and providing immediate feedback to both the patient and the healthcare provider. This innovation not only improves efficiency but also meets the growing demand for accessible and convenient healthcare services.

- Predictive analysis with machine learning

Insurance verification plays a vital role in assessing risk, determining policy eligibility, and combating fraud. However, the traditional manual review and analysis of documents can be time-consuming and prone to errors. To address these challenges, insurers can incorporate machine learning techniques to automate and streamline the verification process. By utilizing ML algorithms and analyzing large volumes of historical data, insurers can predict the likelihood of insurance claims, identify potential fraud, and make the process more efficient. These algorithms enable insurers to make informed decisions and take proactive measures to mitigate risks. For example, using predictive analysis based on machine learning, insurers can estimate the risk associated with offering health insurance to individuals, allowing for precise pricing based on eligibility and past behavior patterns. Leveraging predictive analysis with machine learning not only improves the efficiency of insurance verification but also contributes to more accurate underwriting and pricing strategies.

- Sustainability practices in green insurance verification

With increasing concerns about environmental sustainability, insurance companies are adopting green insurance verification and other sustainable practices. Digital documentation and e-verification methods are becoming standard, helping to reduce paper usage and carbon footprint. By adopting eco-friendly policies and procedures, insurance providers not only contribute to environmental conservation and align with corporate social responsibility but also contribute to cost savings and operational efficiency.Embracing Innovations for Success and Efficiency in Healthcare Insurance Verification

The health insurance industry is witnessing a transformative shift in how patient eligibility verification is done. Blockchain technology ensures secure data management, telehealth services enable remote verification, predictive analysis with machine learning optimizes the process, and sustainability practices promote green insurance verification. Keeping up with emerging trends is crucial for insurers looking to stay competitive, improve efficiency, and deliver enhanced customer experiences.

Want to streamline patient eligibility verification and optimize your practice’s efficiency?